16 Best Tax Software For 2022 [Ultimate Guide]

What is the Best Tax Software?

If you’re like most people, you probably dread doing your taxes. It’s not fun and it can be confusing.

Luckily, there are some great tax software programs available that make doing your taxes a little easier for you. Each of these tax software programs has its pros and cons and you should take a look at each one to see which one is best for your situation.

TurboTax: TurboTax has been around since the late 1980s and has become one of the most popular tax software programs on the market today. The program offers an easy-to-use interface and will guide you through all the necessary steps to complete your return.

TurboTax also provides helpful tips throughout the process, so even those who aren’t familiar with filing their own taxes will be able to complete their return without any problems. Another great feature of TurboTax is that they offer live support via telephone or chat whenever you need it.

They also provide a free audit support service so if your tax return gets audited by the IRS or state, they will represent you at no cost!https://turbotax.intuit.com/

H&R Block: H&R Block has been around since 1955 and offers several different types of

1. Intuit TurboTax

Intuit TurboTax is the most popular tax preparation software, and it’s no surprise why. It’s easy to use and it’s loaded with helpful features that make filing your taxes a breeze.

But if you’re like me, you might have heard about TurboTax but never actually used it before. Well, I’m here to tell you that there are many reasons why TurboTax is the best tax software on the market today:

Easy to Use: Intuit TurboTax has a very user-friendly interface that makes filing your taxes a breeze. It’s easy to navigate between different sections and find exactly what you’re looking for.

You don’t need any special training or technical knowledge to use this program anyone can do it!

Accurate Calculations: This program automatically double-checks all of your calculations for accuracy so that you don’t have to worry about making mistakes while doing your taxes.

If there are any discrepancies or errors in your return, Intuit TurboTax will let you know right away so that you can correct them before submitting them online or printing out your completed forms.

Comprehensive Coverage: Intuit TurboTax covers all of the major deductions and credits available for taxpayers living in the United States including mortgage interest deductions, charitable donations

Key Features

Intuit TurboTax is one of the most popular tax preparation software packages. It’s used by millions of people every year to file their taxes online, and it’s one of the most trusted brands in the business.

Intuit TurboTax has been around for more than 25 years, and it has grown to be an extremely comprehensive program that can handle almost any kind of tax situation.

Intuit TurboTax offers a very wide range of features that make it easy to use for both newbies and experts alike.

Here are some of the best features that Intuit TurboTax has to offer:

Easy-to-use interface: Intuit TurboTax offers a very simple interface so that you don’t have to worry about complex navigation or confusing jargon. The layout is intuitive, with all necessary information clearly visible on each screen.

Dedicated support: If you encounter any problems using Intuit TurboTax, there’s always someone available over the phone or via email who can help resolve your issue quickly and easily without charging extra fees for their services

Pros

Intuit TurboTax. Pros

– Easy to use

– Great for beginners and intermediate users.

– Offers a variety of tax filing options including taxes for the self-employed, partnerships, small businesses and corporations.

Cons

– The software does not have an audit risk meter like H&R Block’s TaxCut Premium does (see below).

Cons

Intuit TurboTax is the most popular tax software for individual taxpayers and small businesses. It offers a large range of features and options, including a free version that you can use to file simple returns.

However, it has some drawbacks, including high prices, complicated navigation, and a lack of mobile app support.

Intuit TurboTax Pros and Cons

Pros

The best-known tax software with the largest number of users.

Easy to use interface makes it easy for anyone to do their taxes at home.

Has more than 100 different versions for different types of people and businesses, which makes it very flexible.

Free filing option available for simple returns (1040EZ, 1040A).

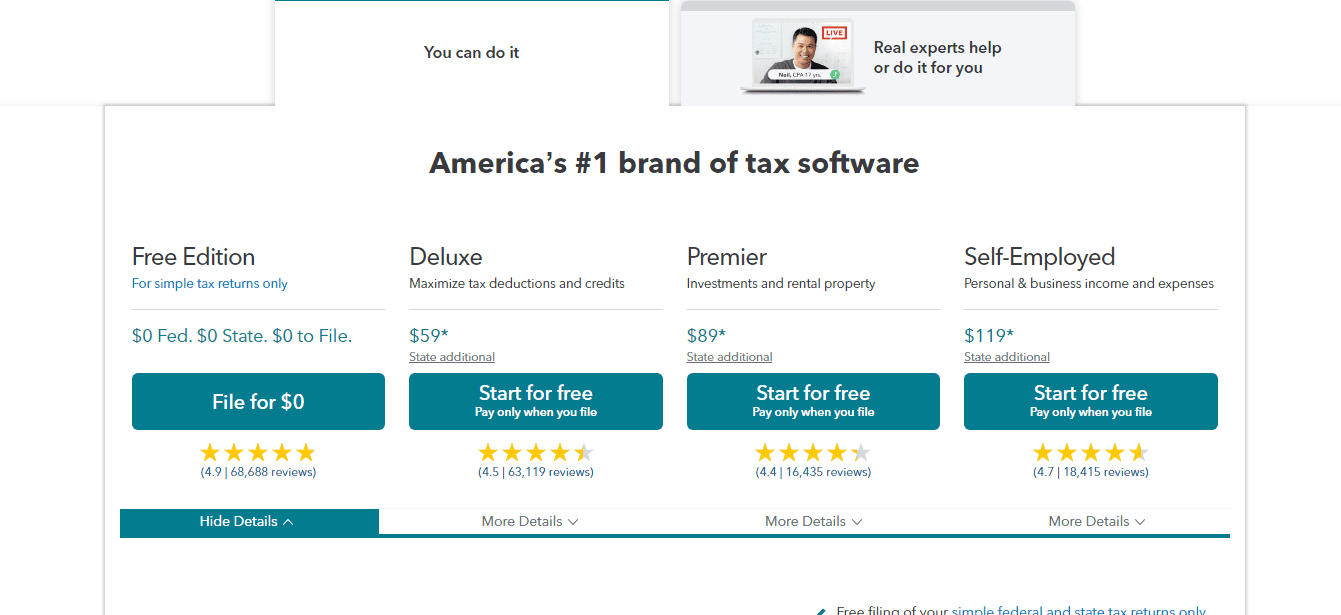

Pricing

Intuit TurboTax. Pricing

Intuit TurboTax is available in two versions, Deluxe and Premier. The Deluxe version is for taxpayers who have simple returns and don’t itemize deductions.

The Premier version is for taxpayers who have more complicated returns, including self-employment income or rental properties.

Both versions of TurboTax are available as an online subscription or download. All prices include the federal e-file fee of $19.99 per return, but not state e-filing fees, which vary by state.

TurboTax Online Basic Edition (Deluxe + State) – $59.99

TurboTax Deluxe + State – $89.99

TurboTax Premier + State – $109.99

Intuit TurboTax. Pricing

Intuit TurboTax Home & Business (2019)

Intuit TurboTax Deluxe (2019)

Intuit TurboTax Premier (2019)

Intuit TurboTax Self-Employed (2019)

2. Liberty Tax

Liberty Tax Service is a tax preparation company founded by John Hewitt and Jerry Ferrell in 1997. Liberty Tax Service was the first franchised tax preparation firm in the United States, with more than 3,800 locations throughout the country.

It is a subsidiary of Liberty Tax, Inc., which also provides mortgage services.

History

The company was founded in 1997 by John Hewitt and Jerry Ferrell as an outgrowth of their previous business: Master’s Tax Service. The two men were based in Houston, Texas, where they had opened their first office in 1992.

They named their new company after the Statue of Liberty because they wanted to “embrace freedom” and “celebrate America.”

Liberty Tax grew steadily over the next several years and expanded into other states beyond Texas. In 2001, it began franchising its services across the country; by 2003 there were more than 250 locations nationwide.

The following year, Hewitt and Ferrell sold their interest in the company to MTH Financial Group Inc., which became its parent company under the name Liberty Tax Services Inc. By 2005 there were more than 1,000 locations across 45 states; at this time Hewitt left his role as CEO but remained Chairman of

Key Features:

Liberty Tax Service is a tax preparation company with more than 3,700 offices throughout the United States and Canada. Liberty Tax Service was founded in 1992 by John Hewitt and his wife, Jackie Hewitt.

The company is based in Kansas City, Missouri, where it has its headquarters. Liberty Tax Service is best known for its television commercials which feature the fictional Uncle Sam character.

Liberty Tax Service offers several different types of services to prepare taxes for individuals or businesses including:

Income Tax Returns

Sales Tax Returns (for businesses only)

Estate Tax Returns (for estates over $1 million)

Pros

Liberty Tax. Pros

- Very affordable.

- Great customer service.

- They are very knowledgeable about their business and are always ready to help their customers.

- They have great locations all around the country, so if one location is too busy you can go to another one nearby and be served right away!

- You can always get in touch with them by phone or email, they will respond quickly!

Cons

Liberty Tax has three locations in the Denver area. It is a good place to go for help with your taxes.

I have been going there for years and have always been satisfied with their service.

There are two things that I don’t like about this business:

1) The lady who works there is very pushy and tries to get you to sign up for other services that you don’t need. I once went in to get my W2s and she kept trying to sell me an e-file service that included state tax return filing and federal checking account deposits.

I didn’t want any of these services but she kept at it until I finally said yes just so she would leave me alone!

2) They charge $10 for each form you need stamped by the IRS, even if it’s something as simple as a W2 or 1099-R form. This can add up quickly because every paycheck has a few forms like these attached!

Pricing

Liberty Tax Service is the largest tax preparation company in the United States. We’ve been preparing taxes since 1983, and we have more than 3,500 offices throughout the country.

Our goal is to make filing your taxes as easy as possible.

We make it easy for you to file your taxes with us by providing free online tax preparation software and free e-filing. You can also submit your return through our mobile app or call us at (888) 919-1040 if you prefer to talk with one of our customer service representatives during tax season.

Liberty Tax Service offers a wide range of services to meet your needs:

Income tax preparation – We prepare all kinds of federal and state income tax returns, including Form 1040EZ, Form 1040A or Form 1040 with schedules A, B, C and D

Self-employed tax preparation – We prepare self-employment taxes for sole proprietorships, partnerships, S corporations and farms. We also handle other business income such as rents from real estate properties and interest from bank accounts.

Depending on the type of business structure you use, we may be able to help you with payroll taxes too

Business filing services – If you own a small business or run a corporation or LLC

3. Jackson Hewitt

Jackson Hewitt Tax Service is the largest tax preparation company in the United States. The company was founded in 1984 by Robert Jackson and Terry Hewitt, who are both still involved with the company today.

Jackson Hewitt has over 6,400 tax offices across the country, making it one of the largest full-service tax preparation companies in the nation.

It has helped more than 20 million families prepare their taxes since its founding and offers a variety of services for all types of taxpayers.

Key Features

Jackson Hewitt offers a variety of tax services, including filing federal and state returns.

The company has been around since the mid-1980s and is one of the largest tax preparation chains in the United States. It has more than 5,000 offices across the country, as well as a home office in Houston, Texas.

Jackson Hewitt offers a variety of services to help you prepare your taxes:

Federal and state tax return preparation;

Tax planning;

Tax audit defense; and

Filing extensions.

Pros

Jackson Hewitt. Pros

- Convenient locations. Jackson Hewitt has more than 1,100 locations nationwide. These are typically in strip malls or in the same shopping center as other financial services companies.

- The company offers online account management and bill pay, but you can also visit your local branch to get help with taxes and other financial matters.

- Free live chat support. Jackson Hewitt offers free live chat support from 9 a.m.-9 p.m. on weekdays and 10 a.m.-8 p.m. on weekends (Eastern Time).

- You can email the company at any time of the day or night with questions about its products and services, including those related to filing taxes with them in 2019-2021 tax season!

Con

Jackson Hewitt has been around since the 1930s, but it’s not the most reliable tax preparer. The company was sued by the Federal Trade Commission in 2010 for deceptive advertising practices, and many of its locations have received poor reviews from customers.

Jackson Hewitt’s fees are higher than some other tax prep companies, and its customer service is often criticized as lackluster. The company also charges an additional $25 fee to e-file your return, which is unusual among major tax preparation firms.

Those who have used Jackson Hewitt’s services say they’ve had problems with missing or inaccurate information on their returns, including mistakes that caused them to owe thousands more than they expected.

Some customers also complained about long wait times and poor customer service when they called in with questions or concerns about their returns.

If you decide to use Jackson Hewitt this year, be sure to double-check all of your information before filing so that no mistakes are made and you don’t end up owing money when you thought you were due a refund

Pricing

Jackson Hewitt is a chain of tax services offices. Their prices are “as low as $29”, but that’s only for basic returns.

If you’re self-employed, have rental properties, have capital gains or losses, etc., the price goes up. Jackson Hewitt provides an estimate of your refund amount when you walk in the door (in addition to telling you how many deductions you can claim).

They also provide a free tax guide and free electronic filing if your return is under $100,000 and you file online instead of going to their office.

The Jackson Hewitt website lists all of their prices online, which is very helpful for comparison shopping purposes.

4. AvaTax

AvaTax is the leading tax preparation software for small businesses and self-employed taxpayers. The AvaTax team has been working on this product for over 10 years, and we are dedicated to making it as easy as possible for you to file your taxes.

AvaTax is the best choice for small business owners and self-employed individuals because it is designed especially for them. Its friendly interface, powerful features, and affordable pricing make it a great choice for independent contractors, freelancers, consultants, contractors and other self-employed workers who need to file their taxes online.

Key Features:

AvaTax is a simple, easy-to-use tax return preparation software that helps you file your taxes with confidence.

– Key features:

– Filing taxes is easy with AvaTax. It guides you through the process and allows you to easily import your W2 and 1099 information from your employer or banks.

– AvaTax automatically double checks all the numbers on your tax return for accuracy and compares them to official IRS guidelines. If there are any discrepancies, it will let you know so you can fix them before filing.

– If you have children (or grandkids), AvaTax will help you take advantage of valuable tax breaks for dependents like the child tax credit and dependent care credit.

Pros

- Comprehensive Tax Preparation Software

- Easy to Use

- Affordable Pricing

- Free Support

AvaTax is one of the best tax software on the market, and it’s easy to see why. With its intuitive interface, step-by-step approach to filing, and excellent customer support, AvaTax is a good choice for anyone looking to file their taxes online.

AvaTax offers a number of different plans that range from $49.99 to $179.99 per year depending on how many returns you want to file.

The basic plan allows you to file up to five returns at once, while the Pro plan allows up to 25 returns for $179.99 per year or $15 per return if paid monthly or quarterly.

The company also offers several add-ons such as state eFile options, eFile extensions, and audit protection insurance coverage that can be added on top of your subscription price if needed.

Cons

Pricing

AvaTax offers two pricing plans:

- AvaTax Basic: $19/month or $188/year.

- AvaTax Deluxe: $29/month or $288/year.

AvaTax is a cost-effective, easy-to-use tax software that helps you complete your tax return quickly and accurately.

The cost of AvaTax depends on how many federal and state returns you file with us. The pricing chart below applies to each state return, but not to the federal return.

Single State Return: $25* (State Return)

Married State Return: $35* (State Return)

Married Federal/Single State Return: $60* (Federal Return)

5. Drake Tax

Drake Tax is a team of dedicated tax professionals who have been helping Canadians for more than 20 years.

We believe in providing our clients with the best possible service at a reasonable price. We’re committed to providing you with professional advice and support throughout the year, so that your taxes are done right from the start.

Our team of dedicated professionals has extensive experience in accounting, tax preparation and financial planning. We are here to help you achieve your financial goals and make your life easier.

At Drake Tax we take pride in ensuring that all of our clients receive personal attention and care. We focus on building long-term relationships with our clients by understanding their needs and providing them with practical solutions that meet their unique circumstances.

Key Features:

Drake Tax is a popular online tax preparation software that can help you file taxes quickly and easily. It has been used by over 3 million people, and it’s trusted by thousands of tax professionals.

Drake Tax is the best way to file your taxes online with the help of an experienced CPA. It offers step-by-step guidance throughout the entire process so you’ll know exactly what to do, which reduces the risk of mistakes.

Key Features:

– Step-by-step guidance throughout the entire process so you’ll know exactly what to do, which reduces the risk of mistakes.

– Help from certified CPAs who are available 24/7.

– Unlimited access to Drake Tax on any device (PC or Mac).

Pros

Drake Tax.Pros

- The customer service is very good. The staff are very helpful and friendly.

- The software is user friendly and easy to use.

- I have had no problems using it at all!

- I really like that they offer free tax advice online and through phone calls, as well as access to their CPAs and EAs who can help answer any questions you may have regarding your taxes.

Cons

Drake Tax is a good tax software for small business owners. It’s easy to use, has a built-in wizard that walks you through your return step by step, and provides all the standard forms you need to file your business taxes.

Pros

Easy to use and understand.

Includes all the forms needed to file your business taxes.

Cons

Expensiv

Pricing

Drake Tax is a full-service accounting firm specializing in small businesses and individuals. We have been serving the needs of clients in the Greater Toronto area for over 20 years.

We offer a wide array of services to our clients, including bookkeeping, tax preparation and planning, financial statements, payroll services, and year-end audits. Our goal is to help our clients make more money by increasing their cash flow and saving them money on taxes.

We work closely with each client to understand their unique needs and provide them with the right solutions at an affordable price. We believe that you should only pay for what you need so we offer different packages based on your specific requirements.

Our pricing includes all preparation fees (including T2 return), processing fees, postage costs and GST/HST where applicable. There are no hidden fees or additional charges unless specifically stated in writing beforehand.

6. Thomson Reuters’ ONESOURCE

Thomson Reuters is the world’s leading source of intelligent information for businesses and professionals. We combine industry expertise with innovative technology to deliver critical information to leading decision makers in the financial and risk, legal, tax and accounting, intellectual property and science and media markets, powered by the world’s most trusted news organization.

We have over 45,000 employees in more than 100 countries that use our software on a daily basis.

Key Features:

Thomson Reuters’ ONESOURCE. Key Features:

– On the go access to your data and reports from anywhere, anytime

– Easy to use

– Save time with easy navigation and search functionality

– Stay current on tax developments and changes as they happen with automatic alerts and information updates

– Manage all your documents in one place – saving you time and money!

Pros

Thomson Reuters’ ONESOURCE. pros is the only financial data solution designed specifically for small businesses and start-ups.

With ONESOURCE. pros, you get the same data and insights as larger businesses without the cost.

Because we know that small businesses need powerful analytics to compete and succeed, we created a financial data solution specifically for them: ONESOURCE. pros.

We’ve taken all of our market leading products and put them into one simple package at an affordable price point so you can focus on growing your business not managing your accounting system.

Cons

Thomson Reuters’ ONESOURCE. Cons

1.Cost of the online subscription is expensive.

2.Not friendly for small businesses and start-ups.

3.The interface is not user-friendly and hard to navigate through different sections.

4.There are only a few articles in the free version, so you have to pay for access to other articles if you want to read more than that or use them as citation sources in your academic papers or other documents.

Pricing

ONESOURCE® Pricing from Thomson Reuters provides the most comprehensive, accurate and reliable information for your pricing needs. We offer a range of subscription packages to meet your specific needs, from a simple single user license to enterprise-level access.

ONESOURCE® Pricing offers the industry’s largest and most comprehensive database of pricing data, with more than 400 million records for over 80 industries in over 40 countries.

ONESOURCE® Pricing provides users with real-time access to up-to-date pricing information, as well as flexible search capabilities to help you quickly find the critical data you need.

ONESOURCE® Pricing includes:

- Over 400 million records – both public and private – including historical data going back five years or more

- International coverage – data is available for over 40 countries

- Easy-to-use search functionality – powerful functionality allows users to search by multiple criteria simultaneously

- Real-time updates – changes are automatically updated on a daily basis

7. QuickBooks

QuickBooks is a bookkeeping software program that helps you manage your business finances. You can use QuickBooks to record sales and purchase transactions, create invoices and track payments.

You can even use it to pay bills and track payroll.

Business owners can use QuickBooks to:

Manage inventory

Pay employees and contractors

Create estimates and invoices for customers

Track customer payments

Generate reports for taxes, financial statements or other business decisions

Key Features:

- Automatic Data Backup

- Easy to Use

- Multiple Currency Support

- Create Invoices and Estimates

- Track Time & Mileage Logs

- Communicate with Clients and Employees

QuickBooks is a popular accounting software that provides small businesses with the tools they need to manage their finances.

Whether you’re just starting out or have been around for awhile, QuickBooks can help you with all your accounting needs, including:

Managing sales and service receipts

Tracking expenses and tracking tax deductions

Generating invoices and managing accounts receivable

Easily managing inventory and payables

Creating financial statements and reports

Pros

QuickBooks. Pros

QuickBooks is the best accounting software for small businesses. It comes with a set of features that makes it easy to manage your daily transactions, track expenses and generate reports. Some of its best features include:

– Easy-to-use interface: QuickBooks has a simple user interface that is easy to understand and navigate. There are no complicated menus or tabs in this software.

All you need to do is open the program and start setting up your account.

– Easy-to-understand reports: You can generate different types of reports based on the information that you need. For example, if you want to know how much money you have made over time, all you need to do is create a chart or graph for that particular time period.

The report will show all the details that you require such as total sales by month or year, total expenses by month or year and so on.

– Integrated tools: With this software, you don’t need any additional tools or services to help run your business efficiently because everything is included in one package! You can use this product as an accounting tool, inventory management system and contact management tool at the same time!

Cons

QuickBooks is a popular accounting software that helps small businesses manage their finances. It offers several features, including accounting, invoicing, payroll and inventory management.

It’s not hard to see why QuickBooks has become so popular over the years. However, there are some drawbacks to using QuickBooks, too. Here are three of them:

- It’s expensive

- You need training to use it effectively

- It’s not designed for freelancers

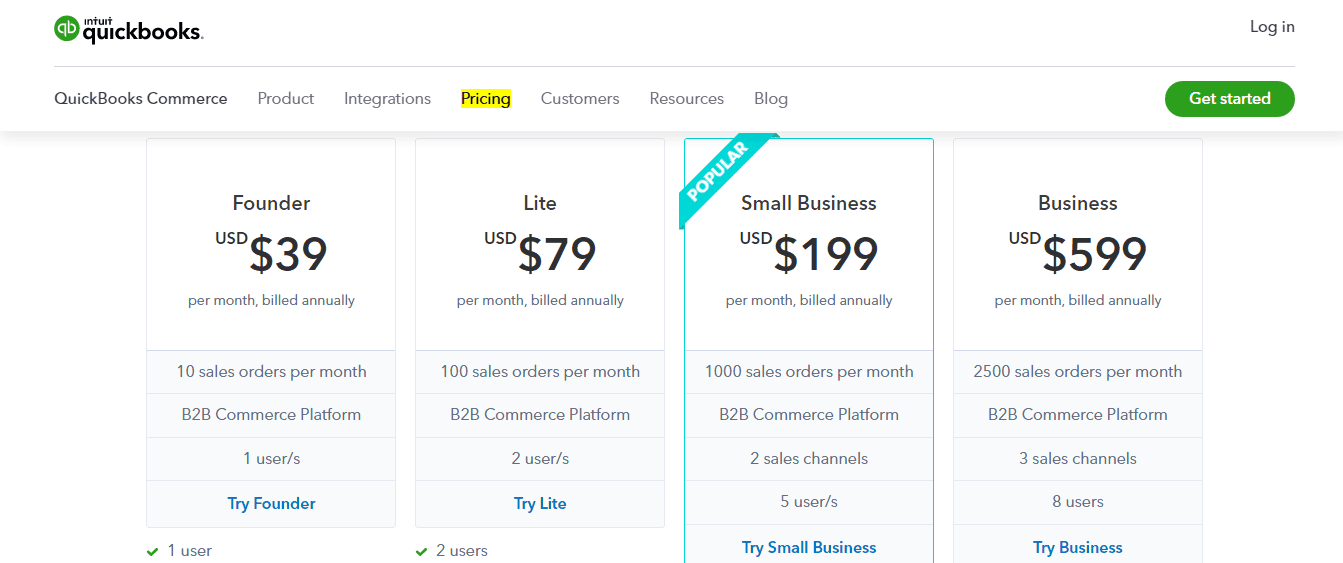

Pricing

QuickBooks. Pricing

QuickBooks pricing is based on a subscription model. You can choose between two different plans QuickBooks Online or QuickBooks Pro both of which are available in several versions.

We recommend that you first use the free 30-day trial to see if this program will work for you and your business.

The following table summarizes the various editions of QuickBooks Online and their prices:

Business Plan/Edition Monthly Price/User Number Of Users IncludeBasic Payroll (per user) Enhanced Payroll (per user) Pro Payroll (per user)

Essentials $10/user/month 1–5 usersYes, based on number of employees Yes, unlimited employees included Yes, unlimited employees included

Standard $12/user/month 1–15 user Yes, based on number of employees Yes, unlimited employees included Yes, unlimited employees included

Premier (recommended for businesses with more than 15 employees) $14/user/month 1–25 users Yes, based on number of employees Yes, unlimited employees included Yes, unlimited employees included

8. Clarus R+D

Clarus R+D is a world leader in clinical development and regulatory affairs. We support all types of pharmaceutical, medical device, biologic, and cosmetic companies to successfully navigate through the complex regulatory landscape.

Our mission is to enable our clients to develop the right products for their markets. Our aim is to provide high quality services that exceed client expectations, value our employees and partners, and contribute to the success of our clients.

Clarus R+D has more than 800 employees across 14 offices in Europe, North America and Asia Pacific regions. Our international team of experts provides a broad range of services including:

Regulatory affairs (RA) support from product development through regulatory approval

Medical writing & clinical documentation review

Key Features:

Clarus R+D.

Key Features:

- Cloud-based platform.

- Easy-to-use and navigate.

- No installation or setup required.

- Multiple users can access the same Clarus R+D account at the same time, even remotely.

- Easy to use and navigate; no installation or setup required.

Clarus R+D, the first in a line of ultra-premium spirits from Clarus Spirits, is the result of more than two years of research and development. Our goal was to create an ultra-premium vodka that would capture the essence of our brand, while also demonstrating how we approach innovation.

The result is a truly unique spirit that has set new standards for vodka quality.

We are proud to present Clarus R+D., which offers an entirely new experience for vodka drinkers everywhere.

Pros

Clarus R+D.Pros

– Strong team of experts in the field of sports nutrition and supplementation.

– They have a great history of producing high quality products, including the popular pre workout supplement Jack3d (original formula). The company has also produced a number of other products that are currently available on the market, including:

– JACK3D Micro, an even more concentrated version of the original Jack3d formula (as well as a reformulated version with DMAA).

– LEGENDARY AMPED, a pre workout blend that contains caffeine and other ingredients to help improve focus and performance.

– PUMP HD, a pre workout product designed to increase blood flow for more explosive workouts.

Cons

Clarus R+D.

Cons

– The Clarus R+D has a small selection of connectors, which limits its usefulness as a “one-stop shop” for information security testing.

– The price point is relatively high for what you get.

– The company seems to be struggling to keep up with the fast pace of technology development and the needs of its customers.

Clarus R+D.

Cons

Clarus R+D is not a good choice for small and mid-sized businesses. It’s only available in the U.S., so if you want to use it internationally, you’ll need to find something else.

The pricing is also a bit higher than most other solutions we’ve tested.

Verdict: If your needs are fairly straightforward, then Clarus R+D might be the right choice for you. It’s easy to get started with and offers plenty of features that will help you get more out of your data by making it more accessible.

However, if you’re looking for something more robust that can handle more complex tasks, then there are better options out there.

Pricing

Clarus R+D. Pricing

Clarus R+D is a revolutionary new price optimization solution that allows you to effectively price your products and services, increase sales and maximize profitability. We help businesses manage pricing via our software solutions and consulting services, including:

Pricing Optimization – Clarus R+D’s patented technology provides a highly accurate and scalable approach to pricing optimization. We provide the tools needed to adjust prices in real time based on market conditions, competitor behavior and other factors.

Pricing Analytics – Our data-driven approach allows you to analyze past performance by SKU, region or product category to identify trends that can help inform future decisions about pricing strategy and tactics.

Price Intelligence – Clarus R+D provides pricing intelligence for thousands of products and services across multiple channels, industries and geographies so you always have the most up-to-date information at your fingertips when making decisions about pricing strategy or tactics.

What is the Best Free Tax Software?

What is the best free tax software? We’ve narrowed it down to five top picks.

If your taxes are simple enough to be done on a form printed from the IRS site, then you don’t need to pay for tax software. But if you have complicated deductions or business income, or if you’re trying to maximize your refund, then you may want to consider using one of these five free tax preparation options.

- TurboTax Free Edition

- H&R Block At Home Free Edition

- Credit Karma Tax Free Edition

- TaxSlayer Pro

- TaxAct

9. OLT Online Taxes

Online Tax Filing for Individuals, Businesses and Self Employed.

OLT Online Taxes provides a fast and easy way to file your taxes online. We’ve made the process simple for you, so that you can spend less time on taxes and more time doing the things you love!

All of our services are backed by live support and 100% accuracy guarantee. Our website is secure and encrypted, with SSL certificate verified by McAfee Secure. We also offer free phone support so that you can call us directly at 855-736-6136 if you have any questions or concerns.

/Key Features:

OLT Online Taxes. Key Features:

– E-File for Free

– File your taxes for free using OLT Online Taxes. The IRS waives the electronic filing fee for all taxpayers with adjusted gross incomes of $66,000 or less, and those who are eligible for the earned income tax credit (EITC) will also have their fees waived.

– Receive a Refund Faster

– Get your refund faster with direct deposit into your bank account. Avoid checks that can be lost in the mail or stolen by identity thieves.

– Help With Your Taxes

– A tax professional can help you understand how to claim various credits and deductions to maximize your refund.

– File Your State Taxes For Free (If Available)

Pros

OLT Online Taxes.Pros

- OLT Online Taxes is a trusted and reliable tax software that has been helping people file their taxes for years.

- OLT Online Taxes provides a free federal trial, which means you can try the software before you buy it!

- OLT Online Taxes is affordable and very easy to use – there’s no need to learn how to do your taxes yourself when you can use the software’s step-by-step instructions to walk you through every part of the filing process!

- OLT Online Taxes offers easy access to customer support whenever you need it, so if you have any questions or concerns about your return, they will be happy to help!

Cons

OLT Online Taxes.Cons

– The software is not free

– It’s a bit complicated to use

– It can take a long time to file your taxes with the program

OLT Online Taxes.Cons

OLT Online Taxes is not a good choice for those who want to file their taxes with the help of an accountant. This service does not allow you to import your previous tax returns or other financial accounts, so it’s hard to see how it would work well for most people.

The program also has a limited number of features and is only available online through its website.

While this program offers a wide range of services, it lacks many of the features offered by competing programs. For example, it does not offer a mobile application and there are no support options available outside of email.

In addition, OLT Online Taxes does not offer any customer support for free users who may need assistance with their returns.

Pricing

OLT Online Taxes is free for most people. But if you’re a business owner, sole proprietor or self-employed, you’ll need to pay a fee:

Federal only: $14.95

State and federal e-filing: $19.95

State only: $9.95

It’s easy to see why you should use OLT Online Taxes. It comes with all the features you need to file your taxes online, and it’s completely free if you’re using it for personal taxes.

OLT Online Taxes offers two pricing plans:

OLT PLUS. $4.99 per return. Includes up to three federal e-files, unlimited state e-files, and unlimited tax advice.

OLT BASIC. $3.99 per return. Includes one federal e-file and unlimited state e-files with no tax advice available (for taxpayers who do not need help with their taxes).

10. Credit Karma

Credit Karma is a free service that provides users with a FICO® Score, credit report and monitoring for their credit. For the first time ever, members can see and track their TransUnion® credit report and score on the Web or from their mobile devices.

Credit Karma is committed to helping people take control of their financial lives by providing them with free access to their credit scores, analysis and insights. Credit Karma is available in English, Spanish, French and German.

Credit Karma was founded in 2007 by CEO and Founder Ken Lin. With more than 12 million members, Credit Karma continues to grow rapidly by helping people make better financial decisions. The company has raised more than $100 million in funding since inception from investors including NEA, Sequoia Capital and Tiger Global Management.

Key Features:

Credit Karma. Key Features:

- Credit Score & Report

Credit Karma’s free credit score is based on data from TransUnion, one of the three major credit bureaus. It’s a VantageScore 3.0, the newest version of the credit scoring model that was introduced in 2006.

- Identity Theft Protection

Credit Karma offers identity theft protection at no cost to you, though you have to sign up for it separately from your account. If you’re hit with an identity theft problem, the company will provide up to $1 million worth of assistance with restoring your good name and reputation.

- Mobile App

The Credit Karma app is available through Apple’s App Store and Google Play for Android devices, as well as through its website. The mobile app includes many of the same features offered on the desktop site, including credit monitoring, alerts and insights into your credit report information (including a score update every 30 days).

Pros

Credit Karma is a free tool that provides your TransUnion® credit score and includes information on the factors that make up your score. You can also get two free credit scores, updated monthly, with a Credit Karma account.

Credit Karma offers:

Free access to your TransUnion® credit report and score

Free monitoring of all three of your credit reports from Equifax, Experian, and TransUnion (with Credit Karma Plus)

Free alerts for suspicious activity on your accounts, like when you have a hard inquiry on your report or if someone opens an account in your name

A summary of all your credit card accounts, loans and mortgages, as well as any collections or public records

Cons

Credit Karma. Cons

-It’s not free, but it’s cheap. $1/month for a basic membership, and it never charges you without your permission.

-It doesn’t have the option to freeze your report.

-The website is ugly as hell, but it works fine.

Credit Karma. Cons

The main problem with Credit Karma is that it can only give you a limited amount of data. If your score is below 700 or so, it’s unlikely that you’ll be able to get your full report from them. They say that this is because the credit bureaus charge them for providing more detailed information, but I suspect it’s also because they don’t want their users to know how bad their situation really is.

In addition, some of the reports from Credit Karma are inaccurate. For example, my wife had a collection on her report from 2009 that showed up as “paid.

” When she called the credit bureau directly, they told her that it was still showing up as unpaid because there was no record of payment in our account history.

Pricing

Credit Karma is free to use and always will be. We’ll never charge you for using our service or selling your information to third parties.

How does Credit Karma make money then?

We generate revenue by helping you find the best credit card for your needs, from our partners and advertisers.

What kind of information can I see in my credit report on Credit Karma?

You’ll see a snapshot of the most important information about your credit report, including:

Credit score A number representing how likely you are to become 90-day delinquent on a particular loan or line of credit. The higher the number, the better. Learn more about what a credit score is and how it works.

Credit report A record of your credit history that’s updated each time new information is added to it, such as new accounts or payments made on existing accounts.

Credit monitoring Alerts when there are changes to your TransUnion® credit report that may affect your score.

11. H&R Block

H&R Block is a tax preparation company in the United States and Canada. The company is headquartered in Kansas City, Missouri and was founded by Henry W. Bloch and Richard E. Drebin in 1955.[2]

H&R Block provides tax preparation services for individual U.S. taxpayers, as well as filing tax returns for corporations (including C corporations), partnerships, S corporations, estates and trusts.

[3] H&R Block also provides online tax preparation software called Free File Alliance.[4] In addition to offering traditional in-person tax preparation services, H&R Block offers online tax filing options through its proprietary software program, SnapTax®,[5] which allows customers to prepare, sign and e-file their federal and state income taxes using a smartphone or tablet device.[6][7]

In addition to its core consumer tax offerings,[8] H&R Block also provides business-to-business (B2B) solutions for employers through its HRBlock.com division[9] and related payroll services.

[10] As of September 2017,[11] HRBlock.com was the largest provider of employer-sponsored benefits in the United States.[12][13][14][15][16]

Key Features:

H&R Block is a tax preparation company that offers its services to taxpayers for free. The company provides both an online and mobile option for clients to file their taxes, as well as a tax refund calculator to estimate how much money will be received.

H&R Block also offers additional products, such as its TaxCut software program, which can be purchased from most major retailers or directly from the company website. TaxCut includes both federal and state tax forms and provides assistance with filing returns electronically or by mail.

To use H&R Block’s free online filing service, clients must have a Social Security number and date of birth, as well as information about wages earned and other income during the year.

This information can be entered manually or imported into the program from an IRS Form 1040-EZ or 1040A form that was previously filed with the IRS or another tax preparation service.

Clients who do not have access to an IRS Form 1040-EZ or 1040A can still use H&R Block’s free online filing service by entering this information manually into their account profile on the website.

Pros

H&R Block. Pros

1. Personalized service and expert advice.

2. Free in-person appointments with a tax professional in your area.

3. H&R Block’s Tax Pro Review, where you can see what a tax professional would charge for each service you need.

4.Tax prep software that helps you find every deduction and credit you’re eligible for, then guides you through the process of preparing and e-filing your return.

5. Tax refund loans from H&R Block Financial Services (which are also available at most retail stores).

H&R Block’s Tax Pros can help with everything from filing to e-filing your federal and state taxes, including tax planning advice if you’re expecting a large refund or owe money on your taxes this year

Cons

– It is not always easy to get ahold of an agent by phone. The wait times can be long, and sometimes you have to listen to the same annoying music over and over again while you wait.

– The online experience is not as smooth as it could be. It doesn’t take into account how much time you want to spend on your taxes, so it can make things a little difficult if you’re pressed for time.

– H&R Block doesn’t have any local offices or in-person assistance which may make it difficult for people who are not comfortable doing their taxes online or don’t have access to a computer or internet connection.

Pricing

H&R Block is the largest tax preparation company in the U.S. and Canada, with more than 10,000 offices nationwide. The company has been around since 1955 and offers a wide variety of services to its clients.

While you can use H&R Block’s software to file your taxes online, it’s not necessary to do so. You can also use an accountant or other tax professional if you prefer to have someone else handle your taxes.

H&R Block offers three main options for filing your taxes:

TaxCut Online (previously known as TurboTax Online). This is H&R Block’s most popular option because it only takes about 15 minutes to complete your return after you answer a series of questions about yourself and your income sources.

TaxCut Online costs $19.95 for federal filing and $39.95 for state filing; however, the price varies depending on where you live and whether you’re filing jointly or separately from your spouse or partner.

In-person preparation at an H&R Block office location (this costs more than doing it from home).

Online account access that allows you to prepare your own taxes from start to finish with no assistance from an accountant or other tax professional (this

12. TaxAct

TaxAct is a tax preparation software package developed by the company of the same name. It is marketed as a cheap alternative to more expensive professional tax software packages and sold through a variety of channels, including the company’s website, retail stores, and Amazon.

TaxAct has been criticized for its confusing interface and poor customer service.

Taxpayers may use TaxAct to prepare their federal income tax return or state income tax return, but not both at the same time.

TaxAct uses the term “tax year” instead of “fiscal year” because it is based on calendar years rather than fiscal years (i.e., from January 1 through December 31). Taxpayers can file amended returns for up to three previous years with an upgrade or add-on purchase.

Taxpayers who have used other online tax preparation software providers like TurboTax may find that TaxAct offers many similar features at a lower price point than its competitors do.

There are several different versions of TaxAct available Deluxe, Premium, and Self-Employed each with its own unique set of features and pricing tiers based on your needs as well as whether you want to prepare just your federal or state return or both at once

Key Features:

TaxAct.Key Features:

- Easy to Use

- No Maximum Balance

- No Minimum Balance

- Quick and Easy Federal Filing

- Free State Filing in Most States

- Online Support 24/7

TaxAct’s suite of services offers a complete solution for your tax return needs.

We offer free state filing, free e-file, and a range of affordable pricing options for our desktop software.

With TaxAct, you can:

E-File – E-File your federal and state income tax returns online with our fast, secure online service.

Payments – Pay your federal income taxes by credit card or electronic funds transfer (EFT) with our secure payment system.

State Filing – File state income tax returns for more than 30 states using our simple, step-by-step process.

Support – Get live help from an expert if you need it, 24 hours a day and 7 days a week.

Pros

TaxAct. Pros

• Low price. TaxAct has the lowest price of any major tax preparation software, and it’s been consistently beating TurboTax in that category since 2004. In the most recent two years, the cost has been $20 less than TurboTax.

• Easy to use and navigate. TaxAct is one of the easiest programs to use, with a simple interface and helpful prompts along the way.

It also offers one-click answers to many common tax questions, which makes filling out forms much simpler than with competitors like TurboTax Deluxe or H&R Block Deluxe.

• Good for small businesses and self-employed people. TaxAct’s business version offers everything you need to prepare a Schedule C and Form 1040 accurately and easily. You don’t have to pay extra for help with depreciation or payroll taxes those features are included in all versions of TaxAct Basic, Deluxe or Premium.

Cons

TaxAct has been around for a long time, and it still offers the best value for your money if you’re looking for a basic tax filing service. The software is easy to use, and its support team is available to help you with any questions or issues you have.

The main downside of TaxAct is that it doesn’t offer some of the more advanced features found in other programs. For example, it doesn’t have a way to import financial data from banks and investment accounts, so you’ll have to enter all this information manually if you want to use it.

Another drawback is that TaxAct doesn’t offer a mobile app, so if you need to file your taxes on the go you’ll need to use another program like TurboTax or H&R Block.

Pricing

TaxAct is a popular choice for people looking to file their taxes online. The company offers a free version of its service, but it’s limited in terms of what you can do.

TaxAct’s free version is limited to 1040EZ forms, and it doesn’t include any help with business tax filing or state returns. If you need help with those taxes, you’ll have to upgrade to one of TaxAct’s paid plans.

TaxAct offers five different plans, ranging from $19.99 per year for basic federal returns to $59.99 per year for all federal and state returns.

There are also three different levels of support available: Basic, Premium and Priority Support. Priority Support costs an extra $5 per month and includes unlimited live chat support during tax season and access to TaxAct experts over email or phone for questions about your tax return or filing process that aren’t covered by the other levels of support (which include email and phone support).

TaxAct also offers a free 30-day trial period so you can test out their software before deciding whether or not you want to subscribe for the full year.

13. FreeTaxUSA

FreeTaxUSA is a free tax filing company that offers free federal and state income tax preparation and efile services.

FreeTaxUSA helps you file your taxes online with confidence, ease and convenience.

You can prepare your tax return with the help of the IRS-certified experts at FreeTaxUSA.com, who will guide you through our secure website and answer any questions you may have along the way.

FreeTaxUSA provides easy-to-use tax software that allows you to complete your federal and state income taxes online, quickly and accurately.

Our user-friendly interface allows our users to file their taxes on their schedule, because they do not have to wait until they have all of their information before they start filing their taxes.

We offer a wide range of features including:

Income Tax Preparation Software – FreeTaxUSA offers the most comprehensive income tax preparation software available online with step-by-step guidance from start to finish. Available for both federal and state returns, our software allows you to complete your taxes in less than 30 minutes!

eFile – Once your return has been completed online, simply select efile as part of the process and we will securely transmit your return directly to the IRS or State Department for review and approval.

Key Features:

FreeTaxUSA is a free tax preparation software that helps you file your taxes online. You can file your federal and state taxes for free.

It is designed for people with simple tax situations, such as those who are married, have one job and no children.

FreeTaxUSA has a simple user interface that makes it easy to navigate and use the software.

FreeTaxUSA Features:

File your federal and state taxes online for free

Prepare your federal return in less than 20 minutes

Supports filing extensions (IRS form 4868)

Provides step-by-step guidance so you don’t miss anything on your return

Offers audit support if questions arise after filing

Pros

FreeTaxUSA. Pros

Free to use

No income limits

Completely free

FreeTaxUSA is a good option for anyone looking for a free tax filing service. You’ll have to pay for state returns, but if you don’t have any income or deductions to report, then you don’t have to pay anything at all.

And if you make too much money to file for free on TurboTax, FreeTaxUSA still offers some help. It’s best if you’re looking for something basic, like a W-2 or 1099 form and nothing more.

Cons

FreeTaxUSA.

Pros

Free

Easy to use

Cons

Limited refund options (direct deposit only)

Cons

The company doesn’t offer a dedicated mobile app, so you’ll need to use the website on your phone to complete and check your return.

You can’t file in advance, meaning you must wait until tax season to file your return.

FreeTaxUSA offers a free version of its software that’s designed for simple returns. You can access it via the website or as a downloadable program for Windows PCs.

The tool has no restrictions on how many people you can file for and allows you to import information from W-2 forms into the program. It also includes several features that help you find deductions and avoid common mistakes, such as an audit alert that alerts you when your return looks like it might be flagged by the IRS.

Pros

FreeTaxUSA is free and easy to use, making it an attractive option for those who want to file their taxes online but don’t want to pay anything extra for the privilege of doing so. The software also allows multiple users to log in at once, which makes it an ideal solution if you’re filing jointly with someone else especially if they’re not tech savvy!

Cons

The free version only supports simple returns; more complex filings require upgrading to one of two paid plans (Basic or Deluxe).

Pricing

FreeTaxUSA offers two options for filing your taxes:

- Free Federal and State Tax Filing

- Premium Tax Filing Service

Free Federal and State Tax Filing is a free service, with no hidden fees, that allows you to file your federal and state income tax returns for free. The amount of time it takes to complete the process will depend on how complex your tax situation is.

If you’re using a TurboTax product, it’s likely that you’ll need more than 15 minutes to complete the process. However, if you’re using FreeTaxUSA, it will likely take less time because there are fewer questions to answer on our platform.

Premium Tax Filing Service is an optional upgrade that allows you to file your federal and state income tax returns quickly and easily all in one place at one low price. You’ll have access to all of our additional features like audit protection, identity verification, and free consultation with certified tax professionals (CPA or EA).

14. TaxSlayer

TaxSlayer is a popular tax software provider with a wide range of products and services. TaxSlayer has been around since 2002 and has over 1 million users. The company offers online and desktop versions for individuals, as well as online versions for businesses and accountants. The company also offers a free mobile app that you can use to prepare your taxes on the go.

TaxSlayer offers several different products to meet your specific needs:

TaxSlayer Pro: A basic tax preparation software designed for individuals and families who have simple returns. This is the most affordable option from TaxSlayer,

costing $14.95 for federal filing and $19.95 for state filing (plus e-file fees). You can file your federal return for free if you earn less than $66,000 per year (or $32,000 if you’re married filing jointly).

TaxSlayer Deluxe: An expanded version of TaxSlayer Pro that includes deductions like mortgage interest, property taxes, charitable donations and more. This is likely too much software for most people but might be useful if you need additional features and want to save some money by using one program instead of two (since you can only file one return at a time). TaxSlayer Deluxe costs $24

Key Features:

TaxSlayer.Key Features:

1.Federal and state e-filing services

TaxSlayer offers its clients to file their federal and state returns electronically, which is a great feature for those who do not want to wait until April 15th to receive their refunds. This service can be used by businesses or individual taxpayers.

It is very simple to use, as all you need to do is enter your information and make sure that it has been entered correctly. Once you have submitted your tax return, you will receive an email confirmation of the submission.

You can also check the status of your submission on TaxSlayer’s website so that you know when it was processed and when it was accepted by the IRS or your state’s department of revenue.

This service costs $19.99 per return, but there are some discounts available if you purchase multiple returns at once or if you purchase other products with this product (for example, buying Quicken Deluxe + State + Fed Efile + State Efile would cost $34.99).

2.Free online filing – Individuals only

TaxSlayer offers free online filing for individuals who earn less than $66,000 annually (or $110,000 for joint filers). To qualify for this offer

Pros

TaxSlayer.Pros

- It’s easy to use. TaxSlayer is a user-friendly online tax software that makes filing taxes a breeze.

- You get your money back fast! If you owe money or have overpaid, you can expect to receive your refund within 21 days of filing your return with TaxSlayer.

- They offer free customer service from 9 a.m.-12 p.m., Monday through Friday, with live chat support available anytime on their website for even more help in filing your taxes with TaxSlayer!

TaxSlayer is a tax-preparation service that offers both a do-it-yourself, online filing option and an assisted filing service. With the latter, customers can use one of the company’s tax experts to help them prepare their taxes.

TaxSlayer’s assisted filing service includes all forms, schedules and deductions you need to file your taxes with the IRS. The company also offers a free version that allows you to file state and federal taxes for free as long as your total income is less than $60,000. If you make more than $60,000 a year, TaxSlayer will charge you $19.99 for state returns and $34.99 for federal returns.

Pros

Free access to expert advice during tax season

Free access to all forms and schedules required by the IRS

Cons

TaxSlayer.Cons

– The biggest problem with TaxSlayer is that they don’t have a free version. So, if you’re a low income earner, or just someone who doesn’t itemize their taxes, this isn’t really an option for you.

– It’s not as easy to use as some of the other options out there.

– TaxSlayer doesn’t have any physical locations where you can go in and sit down with an accountant to talk about your taxes. This isn’t a bad thing necessarily, but it does mean that if you need help with something that isn’t covered by their online chat service or support team, it might be hard to get help without paying extra for it

Pricing

TaxSlayer is a popular online tax preparation solution, and has been since the 1960s. The company was established in 1961 by a former IRS revenue agent named John A. Koskinen. They have been serving their customers ever since.

TaxSlayer provides three different versions of their TurboTax software, which they offer at different price points:

Basic – $0 Federal + $39 State

Deluxe – $0 Federal + $39 State

Premier – $0 Federal + $59 State

They also offer an online version of their TurboTax software called Online Tax Filing that costs $0 for both federal and state returns with no additional fees. This is an excellent option for those who prefer to file their taxes online rather than on paper or by phone.

15. Free File

Free File. If you make $64,000 or less, you can use the IRS’ Free File to prepare and e-file your taxes for free.

This service is only available to taxpayers with a 2015 Adjusted Gross Income of $66,000 or less.

The Free File program includes popular software tax preparation products offered by top-tier companies like H&R Block, Jackson Hewitt and TaxSlayer. The IRS maintains a list of all approved software providers on its website.

If your AGI is between $32,000 and $66,000 (Single), or between $48,000 and $66,000 (married filing jointly), you may be eligible for the IRS’ Free File Fillable Forms product.

This is a fillable PDF version of Form 1040EZ that can be used to prepare and e-file your federal return for free using commercial software or online fillable forms providers such as Credit Karma Tax, H&R Block at Home and TurboTax Online Deluxe Federal + State

If you make more than $66,000 (Single) or $133,000 (married filing jointly), you will not qualify for any of these programs but may still be able to file electronically for free through the Volunteer Income Tax Assistance (VIT

Key Features:

Free File is a free tax filing program that’s available to all taxpayers. Qualifying taxpayers can use Free File to electronically file their federal tax returns and get free federal tax software.

– Free federal and state e-file for eligible taxpayers

– Taxpayers with complex returns may qualify for FREE in-person tax help at a Volunteer Income Tax Assistance location.

– Complete the Free File form to see if you qualify for free federal e-filing.

Pros

Free File is a free tax preparation and e-filing service provided by the IRS. Free file users only pay if their taxes are more than $57,000, are self-employed or owe certain other taxes.

Free File is available through a partnership between the IRS and online tax software companies. The companies provide the software for free to eligible taxpayers, but may charge fees for state returns if you need to file one.

Who can use Free File?

You must meet all three of these requirements to use Free File:

Your 2017 adjusted gross income must be $66,000 or less for single filers and $110,000 or less for married couples filing jointly.

Your 2018 income must be $64,000 or less for single filers and $104,000 or less for married couples filing jointly.

You cannot have used any paid preparers including accountants, enrolled agents or other tax professionals to prepare your 2016 return.

Cons

Free File is a free service offered by the IRS. The program is designed to help taxpayers who make $66,000 or less file their federal tax returns for free.

The Free File Alliance is a group of companies that have partnered with the IRS to offer free electronic filing through their websites.

Cons

Free File isn’t available for everyone and it’s not as easy as it seems. You need to meet eligibility requirements, and your tax return has to be relatively simple in other words, you can’t use it if you own a home or have rental income or dependents.

You also can’t use Free File if you’re self-employed or have investments like stocks, bonds and mutual funds (although there are exceptions). If you’re married but file separately from your spouse, you’re out of luck too.

Some of these restrictions may seem obvious for example, if you make too much money then there’s no point in trying to use Free File but others aren’t as obvious. To see whether Free File works for your situation, visit www.irs.gov/freefile and check out the FAQs section on the right side of the screen under “Frequently Asked Questions.”

Pricing

Free File.Pricing

Free File is a free service offered by the IRS. If you made less than $66,000 in 2018 and have a valid Social Security number, you can file your federal tax return for free using Free File.

To use Free File, you must be able to use brand-name tax software and e-file your return.

You can use Free File if your adjusted gross income is $35,000 or less. You don’t need to have fancy computer skills or special software, but you must be able to answer basic questions about your taxes, provide information from your last year’s tax return and sign an acknowledgement form.

Free File is available only through the IRS website at irs.gov/freefile.

The IRS has partnered with several private companies that offer free online filing services for some taxpayers.

These companies have agreed to provide free federal returns for eligible taxpayers who cannot afford to pay for professional help with their taxes or who want to save money on paid tax preparation software or commercial tax preparation services.

Free File does not include state returns; most states also offer free online filing services through their own websites

What is Tax Software?

Tax software is a computer program that does your taxes for you. Tax software is also known as tax preparation software, tax preparation software, or tax filing software.

Tax software is often used by people with simple returns and those who use the trial-and-error method to prepare their taxes.

Tax preparation programs will ask you questions about your income and deductions, calculate your taxes and give you options to claim certain items. Some programs can also generate forms such as Form W-2 or Form 1099 and make recommendations on which forms to file with the IRS.

Tax preparation programs are available in many formats including software packages like TurboTax®, online programs like FreeTaxUSA® and H&R Block® Online, and stand-alone versions for specific types of returns like Form 1040A or Schedule C.

Some programs allow you to file electronically (e-file). This means that once you’ve completed your return, the IRS receives it electronically instead of having to process paper forms from taxpayers.

E-filing saves the government money because it reduces the need for employees to manually process paper returns. It also saves time for taxpayers since they don’t have to wait for their refund checks after filing by mail

How Do You Choose the Best Tax Preparation Software?

Tax time is here again, and many people are rushing to get their taxes filed. If you’re planning to do your own taxes this year, then you’ll need to choose a tax preparation software program.

There are hundreds of different programs to choose from, and they all have their pros and cons. Some are easy to use while others are more complicated. How do you decide which one is right for you?

First, you need to determine if you want a desktop or online program. A desktop program will run on your computer and can only be used there unless you purchase extra copies for other family members.

An online program is accessed through your Internet browser and can be used anywhere there is an Internet connection available. The advantage of an online program is that it can be accessed at any time of day or night since no additional copies need to be purchased or installed on separate computers.

If you’re looking for an easy way to file your taxes, then TurboTax Deluxe is likely the best choice for you because it offers step-by-step guidance throughout the filing process. It also provides automatic calculations that help prevent mistakes from being made during filing time by alerting users when something isn’t quite right with their return before filing begins so it

1. Software Version

Software Version is one of the most important factors for successful and smooth running of your PC.

It is important that you regularly update your software to the latest version.

There are various reasons why you should update your software:

To fix bugs and errors in your system

To increase performance speed of your computer

To eliminate security risks and vulnerabilities in your system

To take advantage of new features or enhancements in the latest version of your software

2. Need to Prepare a State Tax Return

If you’re self-employed, you typically have to file a Schedule C (Profit or Loss from Business) with your federal tax return. You must also file a state income tax return, if required, and report your business income.

Some states require you to pay estimated taxes throughout the year, while others allow you to pay your entire tax liability in one lump sum when you file your annual return. If you are required to make estimated quarterly payments, these payments are added to the amount due at filing time.

If you have employees in multiple states, you should talk to an accountant about how best to handle the payroll and unemployment compensation requirements for each employer’s jurisdiction.

If you have employees who live in another state than where they work, ask your accountant whether or not they need to be covered by workers’ compensation insurance or unemployment compensation insurance in those states.

3. Help for Tax Deductions

Tax deductions are a valuable part of your income tax return. They reduce your taxable income, which lowers the amount of taxes you have to pay on that income.

The Internal Revenue Service allows taxpayers to claim tax deductions for certain types of expenses, including mortgage interest and medical expenses.

You can deduct certain expenses from your taxes. Deductions reduce your taxable income by the percentage of the deduction, so if you’re in the 25 percent federal income tax bracket and a deduction reduces your taxable income by $5,000, it saves you $1,250 in taxes. These deductions may include:

Medical expenses over 7.5 percent of adjusted gross income (AGI)

Child care costs up to $3,000 per child under 13 years old or disabled family member who needs assistance with basic tasks (child care credit)

State and local income taxes or sales taxes

Mortgage interest paid on primary home or second home

Charitable contributions

4. Consider Open Source Software.

Open source software is a type of software that can be modified by anyone. The source code (the set of instructions used to create the program) is available for anyone to view, modify, and redistribute.

Open source software has some big advantages over proprietary software:

It’s free! Open source software is often available at no cost or at least much less expensive than comparable proprietary alternatives. When you consider all the additional costs of support, upgrades, and licensing fees, open-source offerings can save you money in the long run.

You have control over your data. Open source software gives you control over how your data is stored and accessed.

You can modify it as needed to meet your needs and share it with others if needed.

You can fix bugs yourself instead of waiting for someone else to do it for you. If there’s a bug in an open-source program that affects your business-critical applications, then fixing it yourself may be quicker than waiting for the vendor to fix it for you!

5. Customer Support

Customer support is the process of assisting customers in resolving their problems with a product or service. Customer support is provided by a company to its customers through multiple channels, such as phone, email, or live chat.

The aim of customer service is to handle customer queries and complaints in an effective and efficient manner. It can be described as a two-way communication between the customer and the provider of the service (or goods), where both parties exchange information on issues relating to the product or service.

The purpose of customer support is to resolve customer issues quickly and efficiently, reducing the cost of having dissatisfied customers. Support services can be delivered over a variety of media including telephone, email and live chat.

While some companies outsource their customer support needs to third-party providers, there are also many companies that employ their own agents to provide these services internally.

Tax Software – FAQ

What is tax software?

Tax software is a computer program that helps you to complete your annual tax return. The software guides you through the process of filing your taxes, and then fills in all of the information on your behalf.

How do I download tax software?

Tax software can be downloaded directly from the company’s website, or purchased in stores like Best Buy or Staples.

What are the benefits of using Tax Software?

The biggest benefit is convenience – you don’t have to do the math yourself, and you only need to take a few minutes out of your day to get everything done. You also don’t have to worry about making mistakes, as the software will ensure that all your calculations are accurate before submitting them with the government.

What kind of questions should I ask my accountant?

What is the purpose of tax software programs?

Tax software programs are used to prepare and file tax returns. Tax software programs are available for free and paid use.

They can be used by anyone with basic computer skills.

There are many different types of tax software, including free, online and downloadable versions. Most people will use the online version because it is convenient and easy to use.

The purpose of these programs is to help you prepare your taxes. They ask you questions about your income, deductions, credits, etc.,

and then calculate how much money you should pay in taxes or receive back from the government in refunds or credits.

What is a federal tax return?

A federal tax return is a form you must file with the Internal Revenue Service (IRS) by April 15 each year. The IRS gets your information from your state and federal income tax returns, which is then used to determine how much you owe in taxes and whether you qualify for any tax credits or deductions.

The most common types of federal income tax returns are 1040-EZ, 1040-A and 1040-EZ (short). You may also need to file Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return; Form 2350,

Application for Extension of Time To File U.S. Individual Income Tax Return; or Form 4868-Extension of Time To File U.S. Individual Income Tax Return if you expect to owe at least $1,000 in taxes but not more than $50,000 when filing your return (see IRS Publication 556).

If you expect to owe more than $50,000 when filing your return, you should file Form 7004 instead of Form 4868-Extension of Time To File U.S. Individual Income Tax Return (see IRS Publication 556).

Is the IRS free file program useful?

The IRS Free File program is one of the best options out there for people who have simple tax returns. The program is free, easy to use and can help you file your taxes in no time.

The IRS Free File program is made up of two different ways to file your taxes online:

Free File Software – This program lets you prepare and e-file your federal tax return directly through a software provider. There are over 100 software providers that participate in this program, including TurboTax, TaxAct and H&R Block at Home.

You’ll be able to find an eligible product by searching on the IRS website or by visiting the Free File Software page .

Free File Fillable Forms – This option provides electronic versions of the IRS paper forms that you can complete on your computer and then e-file. If you’ve used a paper form before, this option should be very familiar to you.

You can find this option under “Get Ready for Free Tax Filing” on the IRS website .

Best Tax Software Executive Summary

We have a great tax software that is the best in its category. We have made sure that it is easy for you to use and understand. If you want to know more about this software, then read our review below.

The features of this tax software are as follows:

This software can help you to prepare income taxes efficiently. It has various features that will help you to save time and money. This is because it has been developed by experts who know how to make things easier and better.

You will find that this software has some of the best features available out there today. You can use it on your desktop computer or laptop computer with ease. You will even be able to access the programs from anywhere in the world with ease.

If you want an easy way to file your taxes, then this is the best option available today. It will allow you to do so without any problem whatsoever

The post 16 Best Tax Software For 2022 [Ultimate Guide] appeared first on Filmmaking Lifestyle.