Flights, credit cards and more: How to earn miles with the United MileagePlus program

United MileagePlus miles may not be as valuable as they once were, but they have their place.

You can use them for United Airlines and Star Alliance partner awards with no fuel surcharges, saving you hundreds of dollars per ticket. Further, the airline frequently offers low-cost domestic award tickets and reasonable pricing on long-haul international business class tickets operated by United.

It’s also easy to redeem United MileagePlus miles. United’s website is well designed and shows nearly all available Star Alliance flights online. Because of this, it’s an excellent program for points and miles newcomers who want to earn and redeem miles quickly.

In this article, I’ll show you the best ways to earn United miles — many of which don’t require stepping on a plane.

New to The Points Guy? Sign-up for our daily newsletter and check out our beginner’s guide.

In This Post

Earn United miles by flying

As you’d expect, you can earn United miles by flying with the carrier or one of its partners. However, how you earn United miles depends on several factors, including the airline operating the flight, how you booked the flight and your fare class. Let’s take a closer look.

Flying on United

Over the years, United has changed how you earn miles when flying on United-operated flights. Instead of earning based on miles flown, you now earn MileagePlus miles based on your ticket’s base price (minus taxes). You’ll also earn additional miles if you have MileagePlus elite status — the higher your status, the more miles you earn.

Here’s how many miles you’ll earn per dollar spent based on your level of status:

- General member: 5 miles.

- Premier Silver: 7 miles.

- Premier Gold: 8 miles.

- Premier Platinum: 9 miles.

- Premier 1K: 11 miles.

Here’s an example of how this works. If you buy a one-way United ticket from Chicago to Des Moines with a base fare of $210 and $30 in taxes, you’ll earn 1,050 miles as a MileagePlus traveler without status. However, if you’re a top-tier Premier 1K member, that earning jumps to 2,310 miles.

Note that these earning rates apply even if you’re booked into United’s basic economy fare class.

United flights also count toward earning Premier status, though the carrier changed this process significantly for the 2020 qualification year. Instead of earning status based on miles flown, you’ll now earn it based on how many Premier qualifying points (PQP) you earn or a combination of how many PQPs you earn and Premier qualifying flights (PQF) you take.

PQP is determined based on how much you spend on flights and PQF is based on the number of segments flown on United or its partner airlines.

Related: What is United Airlines elite status worth?

Flying Star Alliance partners

You can earn United MileagePlus miles when flying any of United’s Star Alliance or non-alliance partners — but it can be a little tricky.

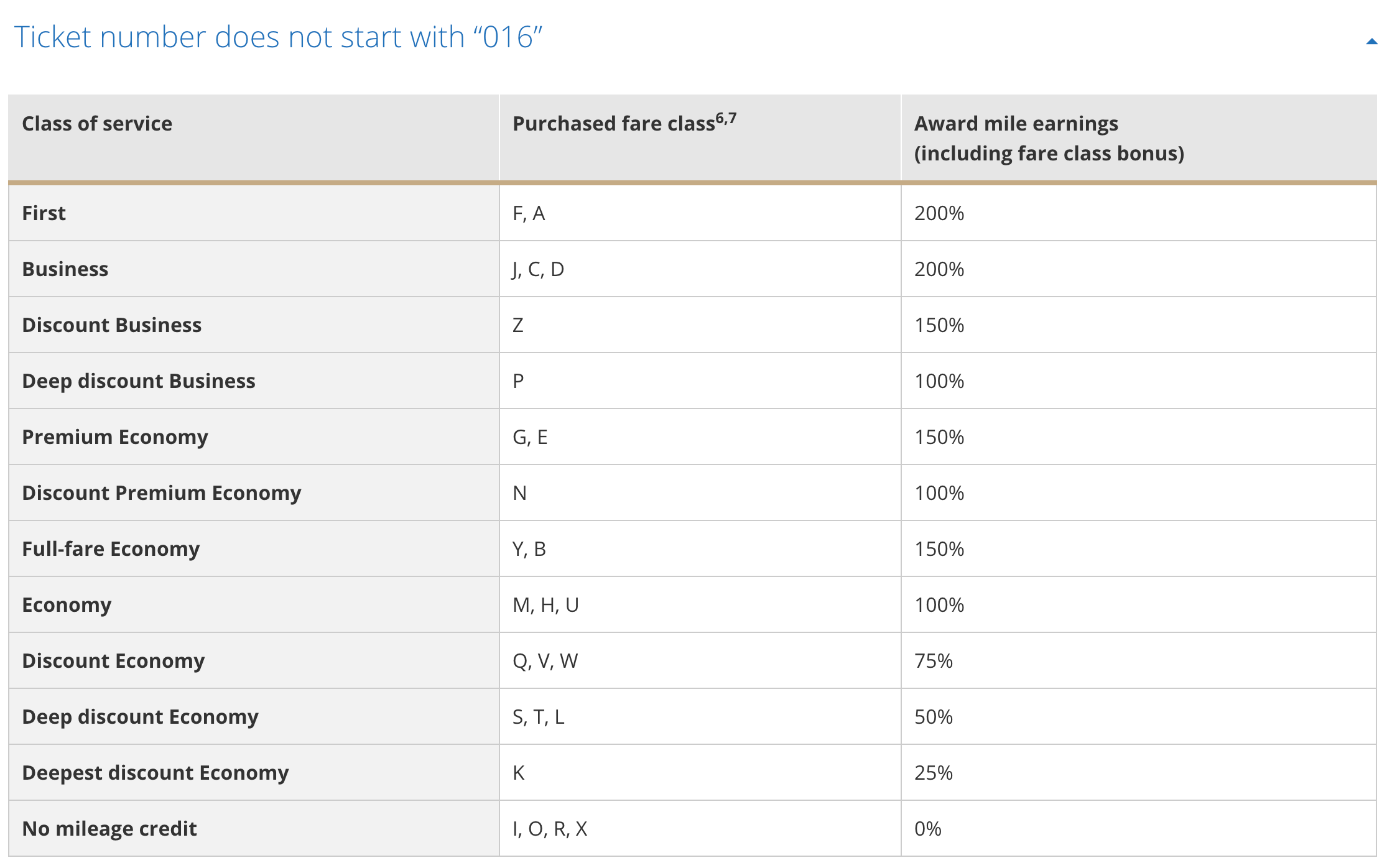

Suppose you book a partner flight through United with a United Airlines ticket number. In that case, you’ll earn miles the same as if you were flying on a United-operated flight: based on the base fare of your ticket and your elite status level (as detailed above). However, if you book the ticket on a partner ticket stock, you’ll earn miles based on your fare class and how long your flight is.

Fares are usually booked on a partner ticket stock when you book directly through the partner airline. For example, if you’re flying on Lufthansa and booked on Lufthansa.com, you’re almost definitely booked on Lufthansa ticket stock. If you book through an online travel agency (OTA) like Orbitz or a credit card portal like the Chase Ultimate Rewards Travel Portal or Amex Travel, these methods may book you on partner ticket stock.

You can verify that a ticket was booked on partner ticket stock by looking at the e-ticket issued after booking. If the ticket number starts with 016, it’s on United ticket stock.

The mileage earning rates vary from airline to airline. So check your booking class by looking at your ticket or calling the airline. Then, head over to United’s list of partner airlines, click on your airline and find the corresponding fare class on that list.

To figure out how many miles you’ll earn, just multiply the mileage flown by the percentage in the “Award mile earnings” column. As you’d expect, fares booked in premium cabins generally earn more miles than economy tickets.

United elite status on partner flights

One of the best ways to qualify for United Premier status is by flying on long-haul, premium-cabin Star Alliance tickets. As mentioned, you generally earn around 1 PQP per dollar spent on United flights. However, on partner airlines, you can sometimes earn over 3 PQPs for each dollar you spend.

Refer to our guide on earning PQPs with partner flights to learn how flying on United’s partners can help you qualify for United status. Just keep in mind that United requires at least four paid flights per year to be on United or United Express to qualify for any status level.

On tickets ticketed and operated by Air Canada, ANA, Austrian, Azul, Brussels, Lufthansa and SWISS, Premier members earn bonus miles (but no bonus PQPs):

- Premier Silver: 25% bonus.

- Premier Gold: 50% bonus.

- Premier Platinum: 75% bonus.

- Premier 1K: 100% bonus.

Let’s unpack this by looking at a real example on a Lufthansa ticketed and operated flight. We’ll start with United’s earning chart for Lufthansa.

Let’s say you’re flying from New York to Munich. Your flight is booked in Z-fare business class, meaning that you’d earn 150% of the mileage flown as per the earning chart above. The flight from New York to Munich clocks in at 4,038 miles, so you’d earn 6,057 redeemable miles. The math looks like this: 4,038 * 1.50 = 6,057.

As noted above, a United Premier Gold member would earn an additional 50% of miles flown, giving them 9,086 miles for this example. Here’s the math: (4,038 * 1.50) * 1.50 = 9,085.5, which would round up to 9,086.

To determine the distance between two airports, use GCmap.com and input your departure and arrival airport codes. It’ll then tell you how far apart the two are in miles.

Related: Your ultimate guide to United Airlines partners

Earn miles with United credit cards

You have a few options for earning United miles with credit cards. The most obvious of these is earning miles with United credit cards. You can quickly rack up miles using these cards to pay for your everyday spending. Additionally, each card has a lucrative welcome bonus that can give you a huge amount of United miles right off the bat — so long as you meet the minimum spending requirement.

Finally, all the cards come with enhanced award availability when it’s time to redeem your hard-earned miles. Here’s a look at all the different credit cards you can use to earn United miles.

United Quest Card

Annual fee: $250.

Sign-up bonus: Earn 70,000 bonus miles after you spend $4,000 on purchases in the first three months your account is open.

Earning miles: The card earns 3 miles per dollar on United purchases, 2 miles per dollar on dining, travel and select streaming services and 1 mile per dollar elsewhere.

Card perks: The United Quest Card — the most recent addition to Chase’s United portfolio — offers many perks to United frequent flyers. The card comes with a first and second checked bag for you and one travel companion when flying United. Plus, you get the following benefits:

- 25% back on United inflight purchases.

- Up to $125 in statement credits as reimbursement for United purchases charged to your card each account anniversary year.

- Get 5,000 miles back per award ticket, up to 10,000 miles per anniversary year.

- Priority boarding.

- Premier upgrades on award tickets (if you have United elite status).

- Up to $100 in statement credits every four years to reimburse a Global Entry, TSA PreCheck or Nexus application fee.

Application link: United Quest Card.

United Explorer Card

Annual fee: $0 annual fee for the first year, then $95.

Sign-up bonus: Earn 50,000 bonus miles after you spend $3,000 on purchases in the first three months your account is open.

Earning miles: The card earns 2 miles per dollar on United purchases, dining and direct hotel purchases, and 1 mile per dollar elsewhere.

Card perks: Aside from earning miles, the United Explorer Card also offers several card perks that make it worth keeping in your wallet. The card comes with a free first checked bag for you and one travel companion. In addition, you get the following benefits:

- 25% back on United inflight purchases.

- Priority boarding.

- Premier upgrades on award tickets (if you have United elite status).

- Up to $100 in statement credits every four years to reimburse a Global Entry, TSA PreCheck or Nexus application fee.

- Two one-time United Club passes each year.

Application link: United Explorer Card

United Club Infinite Card

Annual fee: $525.

Sign-up bonus: Earn 80,000 bonus miles after you spend $5,000 on purchases in the first three months your account is open.

Earning miles: The card earns 4 miles per dollar spent on purchases with United and 2 miles per dollar spent on all other travel purchases, dining and eligible food delivery services. All other purchases earn 1 mile per dollar spent.

Card perks: The United Club Infinite Card offers premium benefits in exchange for a hefty annual fee. In addition to a Global Entry, TSA PreCheck or Nexus credit of up to $100 every four years, the card offers the first and second checked bag free for you and a travel companion. Cardholders also get a United Club membership, Premier Access, 25% back on inflight purchases and more.

Application link: United Club Infinite Card.

United Business Card

Annual fee: $99.

Sign-up bonus: Earn up to 150,000 bonus miles. Earn 75,000 bonus miles after you spend $5,000 on purchases in the first three months your account is open. Plus, earn an additional 75,000 bonus miles after you spend $20,000 total on purchases in the first six months your account is open.

Earning miles: Earn 2 miles per dollar on United purchases, at gas stations, on dining (including eligible delivery services), at office supply stores, on local transit and commuting (including ride-hailing services, taxicabs, train tickets, tolls and mass transit) and 1 mile elsewhere. You’ll also earn 5,000 bonus miles each card anniversary when you have both the United Business Card and a personal United credit card.

Card perks: The United Business Card offers a free first checked bag benefit to cardholders and a travel companion. Other perks include priority boarding and 25% back on inflight United purchases.

Application link: United Business Card.

Transfer Ultimate Rewards points to United

Chase Ultimate Rewards is a popular transferable point currency. Although there are many ways to redeem Ultimate Rewards points, the most lucrative is to transfer points to one of Chase’s airline or hotel transfer partners.

United is one of Chase’s airline transfer partners. So, you can transfer Chase points to United at a 1:1 ratio, effectively turning 1,000 Ultimate Rewards points into 1,000 United miles. Ultimate Rewards has various other transfer partners, including Air France-KLM Flying Blue, British Airways Avios and World of Hyatt. This added flexibility is why we recommend earning Ultimate Rewards points over United miles.

Chase’s suite of Ultimate Rewards-earning credit cards may be a better fit for your wallet. They have broader bonus categories than United’s cobranded cards. So, even if you only plan on transferring your points to United, there’s a good chance you’ll come out ahead with an Ultimate Rewards card.

Here are some of our favorite Ultimate Rewards-earning credit cards that you may want to add to your wallet.

Chase Sapphire Preferred Card

Annual fee: $95.

Sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

Earning points: The card earns 5 points per dollar on travel purchased through Chase Ultimate Rewards, 3 points per dollar on dining (including eligible delivery services, takeout and dining out), 3 points per dollar on select streaming services, 3 points per dollar on online grocery purchases, 2 points per dollar on all other travel and 1 point per dollar on all other purchases.

Card perks: Chase Sapphire Preferred Cardholders get a complimentary DoorDash Dashpass for a minimum of one year. Cardholders also earn 5 points per dollar on Lyft rides through March 2025. Points redeemed through the Ultimate Rewards Travel portal are worth 25% more.

Application link: Chase Sapphire Preferred Card.

Chase Sapphire Reserve

Annual fee: $550.

Sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

Earning points: The Chase Sapphire Reserve earns 10 points per dollar on hotels and car rentals when you purchase travel through Chase Ultimate Rewards, 5 points per dollar on flights when you purchase travel through Chase Ultimate Rewards, 3 points per dollar on dining and travel, and 1 point per dollar on other purchases.

Card perks: Cardholders get various travel benefits, like a $300 travel credit each account anniversary year, a Priority Pass Select membership and up to $100 in statement credits every four years to reimburse a Global Entry, TSA PreCheck or Nexus application fee. Additionally, points redeemed through the Ultimate Rewards Travel portal are worth 50% more.

Application link: Chase Sapphire Reserve.

Ink Business Preferred Credit Card

Annual fee: $95.

Sign-up bonus: Earn 100,000 bonus points after you spend $15,000 on purchases in the first three months after account opening.

Earning points: The card earns 3 points per dollar on select business purchases (up to $150,000 in purchases per account anniversary year) and 1 point per dollar on all other purchases.

Card perks: The Ink Business Preferred card offers free employee cards and the ability to redeem points for 1.25 cents each toward travel booking through the Ultimate Rewards portal.

Application link: Ink Business Preferred card.

The only downside to getting an Ultimate Rewards credit card over a United cobranded card is the benefits; these cards don’t offer free checked bags, priority boarding or other United benefits. The Sapphire Reserve does offer other travel benefits like a Priority Pass Select membership. Still, United flyers may not find it as valuable as a United Club membership on domestic flights.

Related: The power of the Chase Trifecta: Sapphire Reserve, Ink Preferred and Freedom Unlimited

Earn United miles with Marriott Bonvoy credit cards

One of the Marriott Bonvoy program’s best perks is that you can transfer Marriott points to the program’s many airline transfer partners. You can transfer Marriott points to most airline partners at a 3:1 ratio, meaning three Marriott points equal one airline mile. Plus, you’ll get a 5,000-mile bonus for every 60,000 Marriott points you transfer.

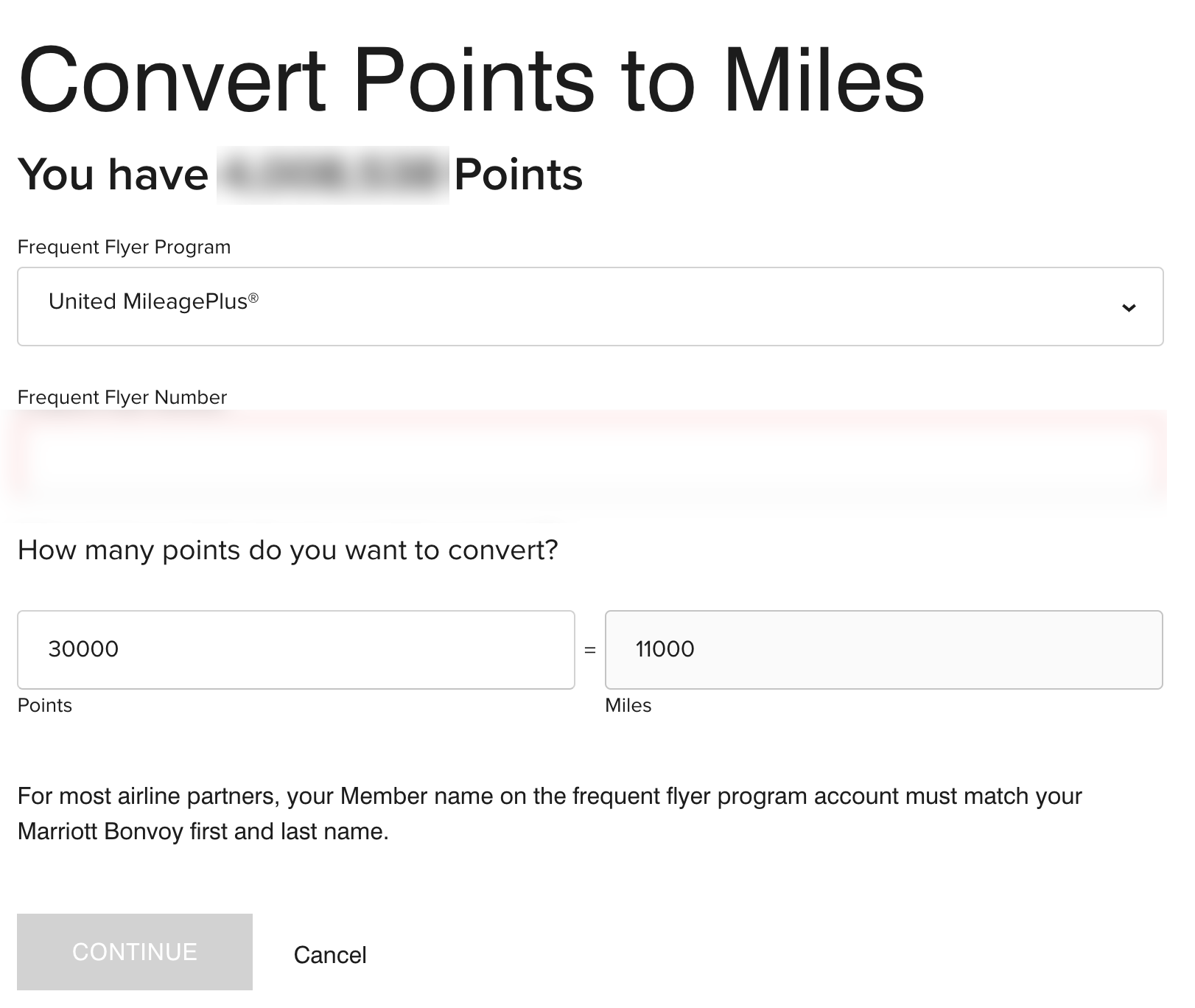

United has a preferred transfer rate due to the airline’s RewardsPlus partnership with Marriott. As of the time of writing, Marriott points transfer to United MileagePlus at a 3:1.1 ratio. This is in addition to the 5,000-mile bonus we mentioned earlier, so transferring 60,000 Marriott points to United results in 27,000 United miles.

Related: When does it make sense to transfer Marriott points to airlines?

To transfer Marriott points to United, log into your Marriott Bonvoy account, head to the Transfer Points to Miles page and click the Transfer Points button at the center of the screen. Then, select United from the airline drop-down menu, enter your United MileagePlus number and enter how many points you’d like to transfer. Click the Continue button at the bottom of the window to initiate the transfer, and the miles will appear in your United account within 48 hours.

You can earn Marriott points in various ways, but the easiest way is through the program’s cobranded credit cards. Here’s a look at the best Marriott cobranded credit cards currently offered:

Marriott Bonvoy Boundless Credit Card

Annual fee: $95.

Sign-up bonus: Earn three free nights (each night valued up to 50,000 points) after spending $3,000 on purchases in your first three months from account opening.

Earning points: The card earns 6 points per dollar at Marriott Bonvoy hotels, 3 points per dollar on the first $6,000 spent in combined purchases each year on gas stations, grocery stores and dining and 2 points per dollar on all other purchases.

Card perks: Marriott Bonvoy Boundless Credit Card holders get an annual free night certificate, good for a property requiring up to 35,000 points per night, every year after their account anniversary. The card also offers 15 elite night credits per year and Marriott Bonvoy Silver Elite status each account anniversary year as a cardmember.

Application link: Marriott Bonvoy Boundless Credit Card.

Marriott Bonvoy Brilliant® American Express® Card

Annual fee: $450 (see rates and fees).

Welcome bonus: Earn 75,000 Marriott Bonvoy bonus points after you use your new card to make $3,000 in eligible purchases within the first three months of card membership.

Earning points: The card earns 6 points per dollar at hotels participating in the Marriott Bonvoy program, 3 points per dollar at U.S. restaurants and on flights booked directly with airlines and 2 points per dollar on all other eligible purchases.

Card perks: The Marriott Bonvoy Brilliant® American Express® Card comes with several valuable perks, like Gold Elite status and the ability to upgrade to Platinum Elite after spending $75,000 in a calendar year.

Cardholders also get up to $300 in Marriott statement credits every cardmember year at hotels participating in the Marriott Bonvoy program. However, this credit will be replaced by a $25 monthly dining credit on Sep. 22, 2022. The card also includes a free night every year after your card renewal month that’s redeemable at hotels requiring 50,000 points or less per night, Priority Pass Select membership and a statement credit of up to $100 toward a Global Entry or TSA PreCheck application fee. Enrollment is required for select benefits.

Application link: Marriott Bonvoy Brilliant American Express Card.

Marriott Bonvoy Business® American Express® Card

Annual fee: $125 (rates and fees).

Welcome bonus: Earn 125,000 Marriott Bonvoy bonus points after you use your new card to make $5,000 in eligible purchases within the first three months of cardmembership.

Earning points: The card earns 6 points per dollar at hotels participating in the Marriott Bonvoy program, 4 points per dollar at restaurants, U.S. gas stations, U.S. wireless telephone services purchased directly and U.S. purchases for shipping and 2 points per dollar on other purchases.

Card perks: The Marriott Bonvoy Business® American Express® Card card comes with automatic Marriott Gold Elite status, 15 elite night credits each calendar year toward the next elite level and an annual free night each year after your card renewal month that’s valid at hotels participating in the Marriott Bonvoy program requiring 35,000 points or less.

Application link: Marriott Bonvoy Business American Express Card.

Earn United miles with travel partners

Beyond airlines, United has a handful of other travel partners like cruise lines, hotels and rental car companies. Here’s a quick look at all some of these partners and how to earn with them.

MileagePlus cruise portal

The MileagePlus cruise portal lets you earn and redeem United miles for booking a cruise.

While the earn and redemption rates vary, you can typically get around 0.6 cents per mile. This is significantly less than the 1.21 cents TPG values United miles. So you’re better off using the booking portal to earn United miles on your cruise. It’s not unusual to earn up to 45,000 bonus miles per booking, even on low-cost cruises.

Related: 6 reasons hardcore cruisers can’t stop cruising

Booking hotels with United partners

United has a suite of hotel partners, too. You can earn miles based on your hotel stay costs using the United Hotels portal, RocketMiles and Points Hound. Each of these online travel agencies (OTAs) lets you book and pay through their website to earn miles on your hotel stays.

Unfortunately, you won’t earn hotel points or get hotel elite status benefits when booking through these portals. We only recommend booking independent hotels and stays at hotels where you otherwise wouldn’t earn rewards. Further, always make sure to compare the cost of the stay with booking directly.

United also has a partnership with Villas of Distinction, where you can earn 3 miles per dollar on luxury vacation villas.

You can also earn United miles when you book directly with a handful of United’s travel hotel partners. Sometimes this means you’ll earn based on the price of your hotel stay. Other times it means transferring points from a hotel program to United MileagePlus.

Here’s a look at how many miles you can earn:

| Hotel | Earning rate |

| Accor Live Limitless | Points transfer at a 2,000:1,000 ratio. |

| Choice Privileges | Earn 250 miles per stay.

Points transfer at a 5,000:1,000 ratio. |

| World of Hyatt | Earn 500 miles per stay.

Points transfer a 2.5:1 ratio. Plus, receive a 5,000-mile bonus when you convert 50,000 points into 20,000 miles. |

| Hilton Honors | Points transfer at a 10,000:1,000 ratio. |

| IHG One Rewards | Earn up to 2 miles per dollar, depending on the property.

Points transfer at 10,000:2,000 ratio. |

| Marriott Bonvoy | Earn up to 2 miles per dollar, depending on the property.

Points transfer at a 3:1.1 ratio, with a 5,000-mile bonus awarded for every 60,000 transferred. You can also visit united.com/MarriottBonus to earn 500 miles on Marriott stays that link with your United flights. |

| Marriott Vacation Club | Vacation Club points transfer at a 500:8,000 ratio.

Up to 40,000 miles per member per year. |

| Radisson Rewards | Points transfer at a 2,000:200 ratio. |

| Shangri-La Gold Circle | Earn 500 miles per stay.

Points transfer at a 2,500:2,500 ratio. |

| Wyndham Rewards | Earn up to 2 miles per dollar, depending on the status level.

Points transfer at a 6,000:1,200 ratio. |

Rental car partners

United recently ended its partnership with Hertz and now has a relationship with Avis and Budget.

MileagePlus members can earn up to 1,250 award miles per qualifying rental. Also, get savings of up to 35% off with the MileagePlus Avis Worldwide Discount (AWD #) A791500 and Budget Customer Discount (BCD #) B204900.

Here’s what you can expect to earn on an Avis or Budget rental with your status:

- No status: 500 miles.

- MileagePlus Chase cardmembers: 750 miles.

- Premier Silver and Gold members: 1,000 miles.

- Premier Platinum and Premier 1K members: 1,250 miles.

Related: How to never pay full price for a rental car

United packages

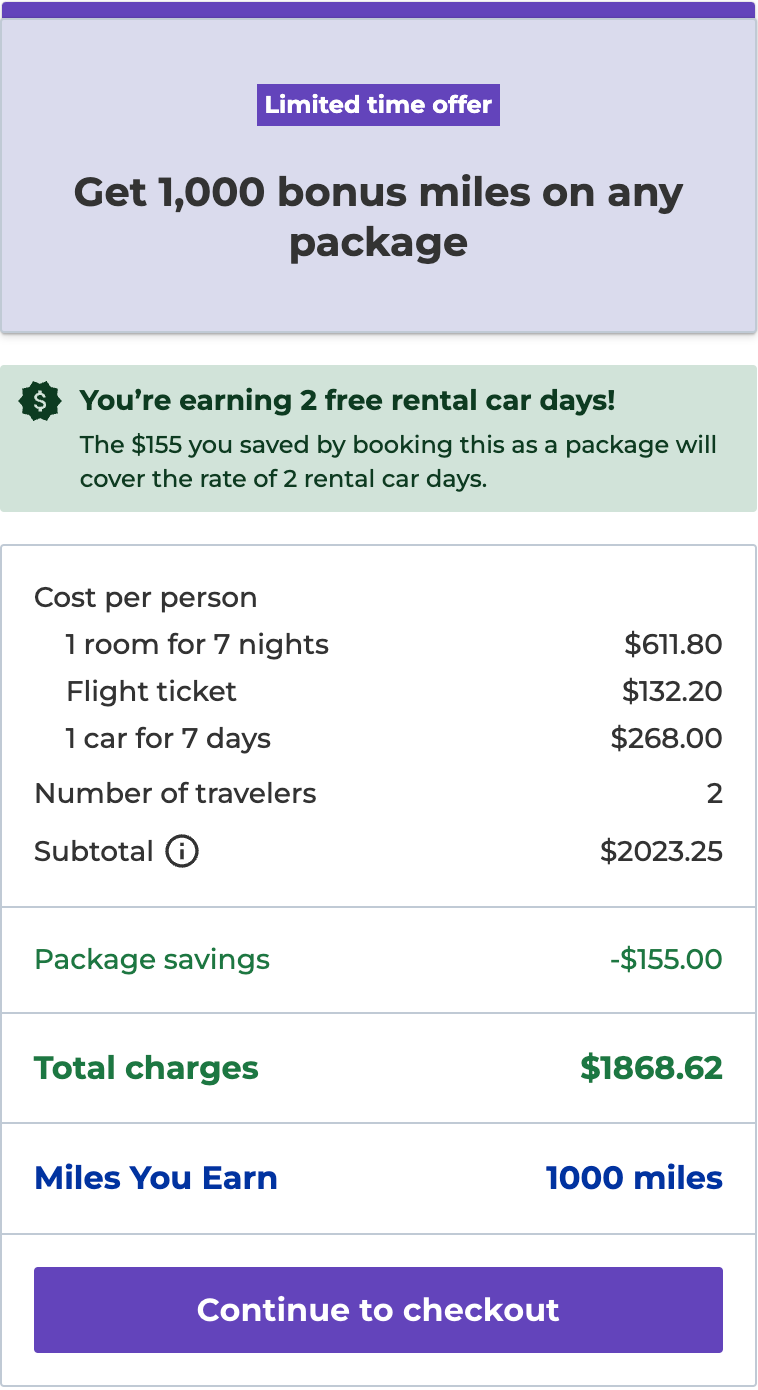

United also offers vacation packages where you can book a flight and hotel; flight and car; or a flight, hotel and car. Priceline powers this service. When I ran a seven-night flight, hotel and car package search from San Francisco to Los Angeles, it clocked in at just under $2,000 with a compact car from Budget and a standard king room at the Sheraton Gateway Los Angeles Hotel.

By booking a package, I’d get two free rental car days and 1,000 bonus miles as a limited-time offer.

Earn United miles with other partnerships

While flying and using cobranded credit cards are the primary methods to earn United miles quickly, there are also many non-travel-related MileagePlus partners. Here are some of our favorites to help you earn extra United miles.

MileagePlus Shopping

Like most airlines, United operates an online shopping portal (MileagePlus Shopping), where you can earn miles for making everyday purchases online. Just sign up for an account and find your merchant on the site before making a purchase.

Starting at this portal rather than the specific retailer’s site will give you extra miles on your purchases in addition to the rewards you’ll earn using your credit card of choice. This can be a great way to earn 1, 2 or even 5 additional miles when shopping online.

In addition, MileagePlus Shopping frequently runs holiday and seasonal promotions. Keep an eye out for these promotions and use them to earn even more on your online purchases.

However, we recommend using a shopping portal aggregator like Cash Back Monitor to see which portal offers the best return on your purchases.

Related: Which credit card should I use in shopping portals?

MileagePlus X app

Download the MileagePlus X app to earn United miles on the go. Simply put, you use the app to buy gift cards to select merchants. The gift card is available immediately and you can purchase it in any amount. When making a MileagePlus X purchase, you’ll earn a select number of miles per dollar.

Participating merchants include major brands like Walmart, Staples and Panera Bread. Be sure to give it a look before you make your next purchase. One of the best things about the MileagePlus X app is that miles are awarded instantly in most cases. So if you’re ever a few miles away from a redemption, buy a gift card to a store or restaurant you frequent.

Best of all, primary United Chase Cardmembers earn a 25% bonus on miles earned from MileagePlus on eGift Card purchases.

Related: Here’s why it matters which card you use to pay in the United MPX app

United MileagePlus Dining

Like most other domestic carriers, United has a dining rewards program that’s part of Rewards Network: MileagePlus Dining.

In short, this is a shopping portal for eating out. Just sign up for an account and link the credit cards you use for dining. You’ll earn up to 5 miles per dollar when you swipe a linked card at participating restaurants. These earnings are in addition to what you earn on the credit card you use, so be sure to use one that offers a category bonus on dining purchases.

To maximize your earnings with MileagePlus Dining, you’ll want to get select status and try to snag VIP status. Becoming a select member is easy: sign up for the program and enable email alerts. Doing so will get you an earning rate of 3 miles per dollar.

Once you’ve made 11 dining purchases in twelve months, you’ll reach VIP status and start taking home 5 miles per dollar. If you don’t opt in to receive emails from MileagePlus Dining, you’re considered a basic member (and will only earn 1 mile per $2 spent).

Related: 10 of the most generous airline and hotel dining rewards programs

Small businesses can earn rewards with PerksPlus

United’s PerksPlus program lets businesses earn rewards on employee travel. Sign up for the program and you’ll be issued a PerksPlus number that you, your employees and your travel agent can add to work-sponsored travel operated by United, All Nippon Airways (ANA), Austrian Airlines, Brussels Airlines, Lufthansa and SWISS. Your business will earn PerksPlus points based on the cost of a ticket.

You can redeem these points for United elite status for employees, award travel certificates, United Club memberships and more. You can use these to reduce employee travel costs or enhance your travel experience. PerksPlus points are earned in addition to the miles an employee earns when traveling, so both parties win. Check out United’s PerksPlus website to learn more and enroll.

Related: Airline loyalty programs for small businesses

Buy United miles

If you need United miles in a pinch, you can opt to buy them from the airline. Unfortunately, however, it’s usually quite expensive to do this. The standard price for United miles is well over 2 cents per mile, which is rarely worth it unless you need to buy a small number of miles to top up for an award.

United frequently runs mileage sales that drop the cost of miles considerably. Even so, you should only buy miles when you have a specific redemption in mind and have already found bookable award space. Be sure to compare the cost of an award ticket against the cash fare before booking with miles.

Bottom line

As you can see, there are many ways you can earn United miles. The most robust approach is to use the above methods in tandem. If you use all of the discussed earning methods at once, you’ll unlock some terrific earning rates that will quickly get you within striking distance of your next award trip.

We recommend starting with a credit card to earn United miles on everyday purchases and then moving on to the other methods discussed. This will ensure you’re leaving no miles on the table when you book travel and make everyday purchases.

For rates and fees of the Marriott Bonvoy Business Card, click here.

For rates and fees of the Marriott Bonvoy Brilliant Amex, click here.

Additional reporting by Kyle Olsen.

Feature photo by AaronP/Bauer-Griffin/GC Images.