What Is Cryptocurrency + How Does Cryptocurrency Work?

Whether you’ve heard about people using crypto to buy their groceries at Whole Foods or their coffee at Starbucks, cryptocurrency is a trending topic — and investment.

In fact, the value of all cryptocurrencies is worth trillions of dollars today.

Even if you’re among the crypto-curious, you might still be asking yourself, “Just how does cryptocurrency work?” Follow along to learn about crypto, its advantages and disadvantages, and best practices for getting started with cryptocurrency safely.

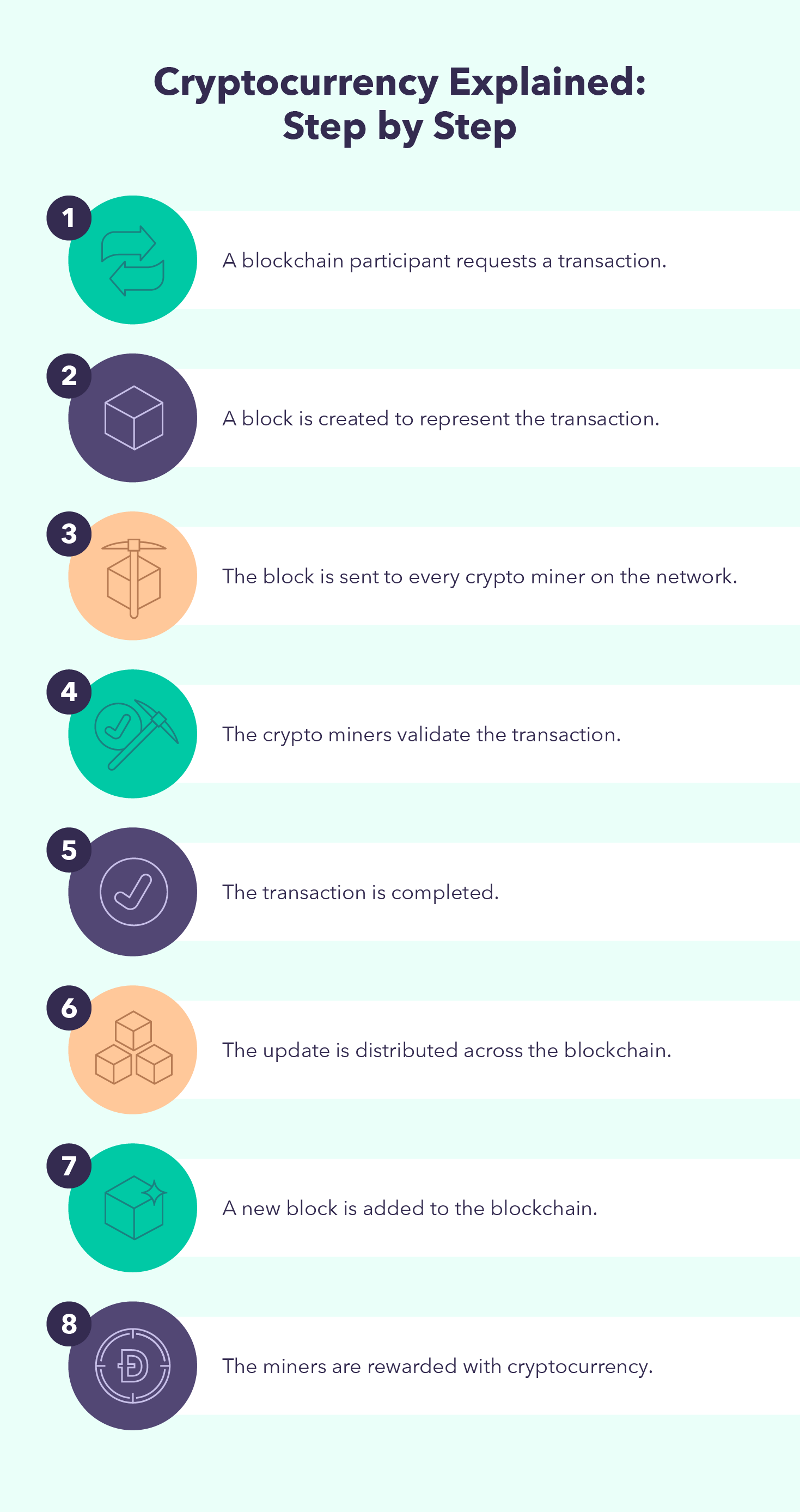

How Does Cryptocurrency Work?

Cryptocurrencies are decentralized digital currencies that live on a blockchain. Unlike physical cash, cryptocurrencies are intangible and can be exchanged digitally with others around the world.

Now, you may be asking yourself, “So, where does crypto come from?”

Cryptocurrencies are created by a process known as mining. When mining crypto, computers solve complex math problems to validate crypto transactions and generate new coins.

Crypto users can also purchase these currencies from brokers or on online exchanges. Once you’ve purchased crypto, you can store your coins either online or offline in a crypto wallet. Depending on your specific trading needs, there are many types of wallets to choose from.

While you can use crypto to pay for goods and services, many people invest these currencies instead. Crypto investors buy and sell digital coins online, similar to trading stocks. In the U.S., cryptocurrencies are legal and treated as financial assets in the eyes of the Internal Revenue Service (IRS). Because of this, you’ll pay capital gains tax on the increase in value after selling your crypto.

Cryptocurrency Examples

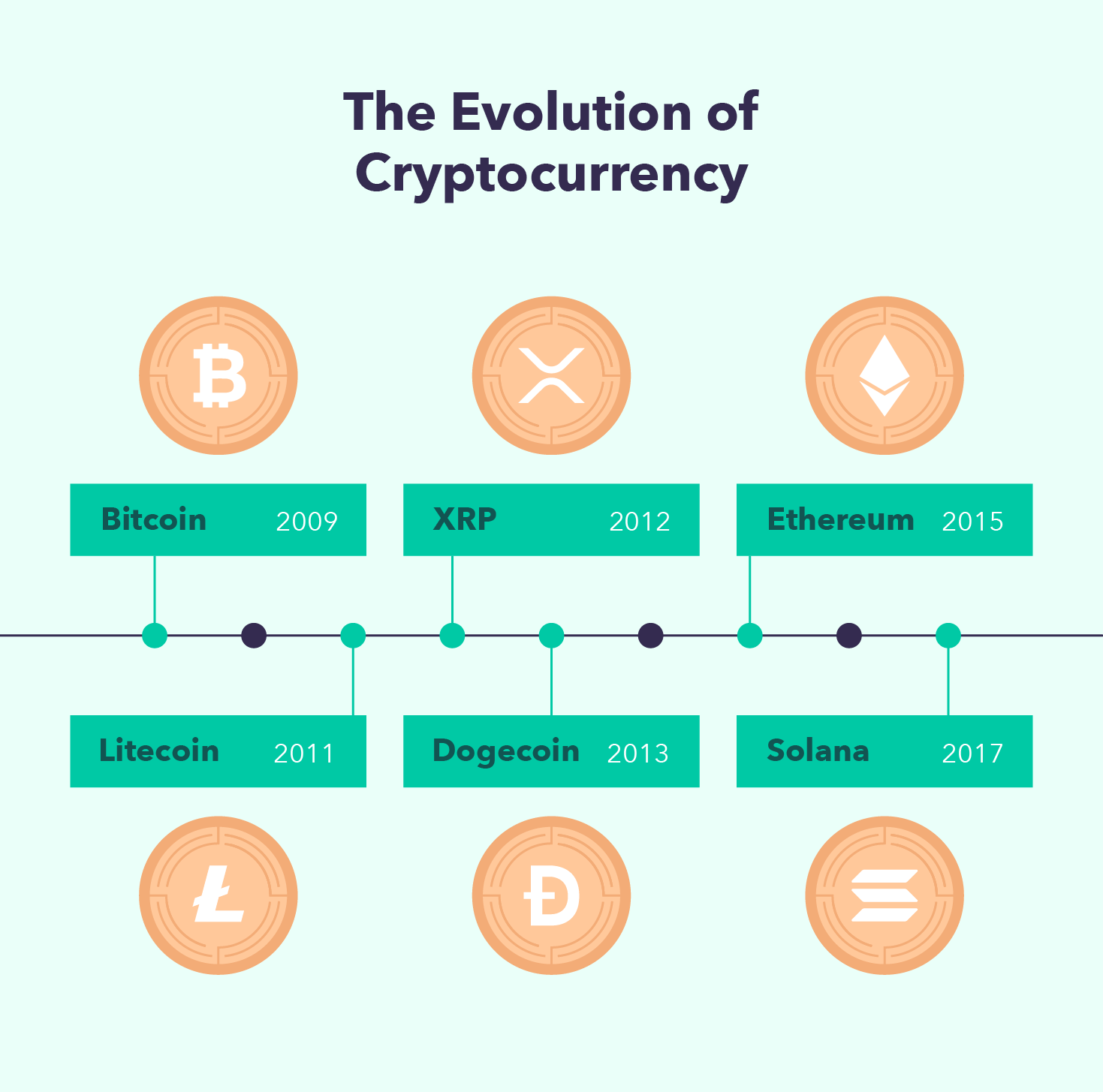

Currently, there are over 19,500 different cryptocurrencies. Of these, here are the most common examples of cryptocurrencies:

- Bitcoin: As the first cryptocurrency ever invented, Bitcoin has become one of the most popular and valuable cryptocurrencies.

- Litecoin: Created shortly after Bitcoin, Litecoin is the second cryptocurrency ever created. It was designed to improve upon Bitcoin by having faster transaction speeds.

- XRP: As the native cryptocurrency of the Ripple digital payment network, XRP is praised for its quick and secure global transactions.

- Dogecoin: Originally started as a joke, Dogecoin has gained popularity and a cult following.

- Ethereum: Often used for more complex transactions, Ethereum is also commonly used for buying and selling NFTs.

- Solana: A competitor to Ethereum, Solana is known for its fast and low-cost transactions.

These are just a few of the options you can currently invest in. Let’s go over the advantages and disadvantages of cryptocurrency.

Advantages and Disadvantages of Cryptocurrency

| Pros of Cryptocurrency | Cons of Cryptocurrency |

|---|---|

| Decentralization | Lacks complete anonymity |

| Ease of use | High volatility |

| Speed | Harmful to environment |

| Security | Used for illegal activity |

Cryptocurrencies were invented in hopes of revolutionizing our financial world on the heels of the 2008 financial crisis — and reducing the thickness of our wallets. As with any investment, using cryptocurrency has its pros and cons. Before diving in, let’s look at some of the advantages and disadvantages of cryptocurrency.

Advantages of Cryptocurrency

As a crypto user, you’ll never have to walk around with a pocket full of loose change. In addition, there are other unique advantages to using crypto.

- Decentralization: Cryptocurrencies are entirely decentralized. Because of this, you don’t have to worry about a single entity, like a bank or government, causing a large-scale financial crisis.

- Ease of use: You can easily transfer funds to other parties without the help of a bank or credit card company.

- Speed: Because you won’t be using any third-party intermediaries, you’ll be able to transfer cryptocurrency much faster than a traditional money transfer.

- Security: The blockchain technology that cryptocurrency relies on is highly secure, providing you with the peace of mind that your crypto is safe.

While crypto certainly has its upsides, there are still a few kinks that need to be worked out before it’s as widely accepted as traditional currencies.

Disadvantages of Cryptocurrency

Like any currency, crypto isn’t perfect. Here are some of the downsides to using cryptocurrency:

- Lacks complete anonymity: Although cryptocurrencies are sometimes talked about as entirely anonymous, that is not exactly the case. While your transaction history won’t be linked to your name, government agencies can still track financial activity attached to your crypto address.

- High volatility: The values of cryptocurrencies tend to change rapidly. Because of their high volatility, you may be taking a significant risk when investing.

- Harmful to the environment: Due to the electricity required to mine crypto, it is estimated that Bitcoin alone is responsible for over 114 million tons of carbon dioxide a year.

- Used for illegal activity: Although it is possible to trace cryptocurrency transactions, many criminals have used crypto as a safer alternative to traditional currency for making illegal transactions or laundering money.

When weighing the pros and cons of crypto, consider your specific spending and investing needs.

How to Purchase Cryptocurrency Safely

Now that you know how crypto works, you may be wondering how you can purchase it. Before getting started with cryptocurrency, follow these four simple steps to ensure you’re buying crypto safely.

Step 1: Choose a Cryptocurrency Platform

The first step when getting into cryptocurrency is deciding which platform to use. Generally, you can purchase crypto in two ways:

- Traditional brokers: Online brokerages offer different ways for you to buy and sell crypto. These brokers may also provide other financial assets such as stocks and ETFs. Usually, these types of brokers have fewer crypto-friendly features and cheaper trading costs than crypto exchanges.

- Cryptocurrency exchanges: These platforms are specifically designed for buying and selling crypto. They often support many different types of cryptocurrency and include wallet storage and account options where you can earn interest. Some platforms may charge usage fees.

Step 2: Decide How You’ll Pay

Once you select a cryptocurrency platform, you must then decide how to pay for your crypto. Most crypto investors use fiat currencies such as the U.S. dollar. While starting, you will likely use your debit or credit card to purchase cryptocurrency. If you’d rather not use a card, many exchange platforms also support electronic money transfers across the automated clearing house (ACH) network as well as wire transfers.

After you become more familiar with crypto investing, you may decide to use your existing crypto to buy other types of cryptocurrency. For example, you may use Bitcoin to purchase Ethereum or vice versa.

Step 3: Add Credit to Your Account

After you figure out which payment method is best for you, you’ll then transfer the money into your account. It is also important to note that different exchanges and brokerages could have fees for buying and selling crypto. To ensure you aren’t hit with any surprises, be sure to research the fees associated with your chosen crypto platform.

Step 4: Select a Cryptocurrency

Now that you have money in your wallet, you can start looking for different crypto assets. Depending on the crypto platform you use, you may have access to dozens of different types of cryptocurrency. While crypto technology is secure, the coins themselves can be volatile. If you’re concerned about the safety of crypto, be sure to spend time researching the coin and platform you plan to invest on.

5 Cryptocurrency Investing and Security Tips

No matter what type of investment you’re interested in, there are plenty of people trying to take advantage of investors with scams. Crypto scammers may try to fool you by making fake websites, setting up digital Ponzi schemes, or posing as celebrities online.

In these scams, you’ll be promised significant guaranteed returns in exchange for a small investment. In other scams, you’ll be fooled into thinking that a new cryptocurrency is the next big thing. After scammers recruit more people, they’ll drive up the price and then sell their shares, profiting off you and others. To help avoid this, follow these five steps for investing in crypto safely.

1. Research Before Investing

Before you start investing, it’s important to do your own research on the trading platforms and cryptocurrency you’re interested in. To help make a decision, read platform reviews and talk to other investors. This can help ensure that your money and crypto are in safe hands.

2. Properly Store Crypto Assets

If you own crypto, it’s crucial that you store it properly. Depending on your personal preference and security needs, there are many different ways to store your crypto. Here are some common crypto storage options:

- On-platform storage: Many investors opt to leave their crypto assets on the exchange platform they bought them on. This allows for a quick and easy experience when trading cryptocurrency. It’s important to note, however, that your crypto could be at risk if the exchange platform has a security breach.

- Hot wallet: These wallets are web-based and connected to the internet. When using a hot wallet, you can easily and quickly transfer your crypto wherever you need it. Because of their online connectivity, hot wallets are less secure than cold wallets.

- Cold wallet: Also known as an offline wallet, this type of wallet is much more secure than a hot wallet. Cold wallets are small hardware devices that store your crypto offline. With a cold wallet, your funds cannot be touched without access to your physical wallet device. Because they’re offline, it is a much more time-consuming process to transfer funds online.

With many different storage options available, be sure to do your research and select one that best aligns with your asset value and trading needs.

3. Diversify Your Cryptocurrency Investments

Diversifying your assets is a crucial part of any successful investment strategy. When investing in crypto, be sure not to put all of your eggs in one basket. For example, investing all of your money into a single cryptocurrency could be risky. Instead, it may be safer to spread your money out across a few different cryptos you trust.

4. Never Share Your Keyphrase

Buying and selling cryptocurrency requires a private keyphrase. This keyphrase is needed to trade crypto and prove ownership of your crypto assets. Just like any password to an online account, it is crucial that you never share it with anyone. If someone figures out your keyphrase, they can do whatever they want with your crypto.

It’s also vital that you never lose your keyphrase. Without your private key, you’ll lose access to all of your cryptocurrency, therefore losing your investment.

5. Know the Risks of Making Investments

Before you start crypto investing, be sure to consider your investment goals. As with all kinds of investments, it’s important that you understand your risk tolerance, as you could lose your money. Because of this and crypto’s high level of volatility, be sure to invest responsibly.

Now that you understand how cryptocurrency works and some of the crypto-related terminology, you might consider taking the leap from being crypto-curious to a beginner crypto investor — get started by choosing the right crypto platform for you. Happy mining!

Sign up for MintCryptocurrency FAQs

Have more questions along the lines of, “How does cryptocurrency work?” We have answers.

A blockchain is a shared and distributed digital public ledger that is completely decentralized. In terms of crypto, a blockchain stores a complete record of crypto transactions. In other words, a blockchain is a secure way of recording transactions that is impossible to change.

“The point of cryptocurrency is to provide a quicker, easier, and more secure alternative to traditional currencies. It was designed to improve upon traditional currency by being completely decentralized and giving power to the crypto holder rather than a bank or government entity.

Crypto investors make money by selling their crypto at a higher value than when they purchased it. For example, if you bought a single Litecoin in July 2021 when its value was $107.30, you might’ve considered selling it in November 2021 when its value went up to $279.36. You would’ve made $172.06 from the sale.

Cryptocurrency may be a good investment if you have a relatively high risk tolerance. In comparison to other investments such as stocks or bonds, cryptocurrency prices are much more volatile. Because of this, cryptocurrency may not be the best investment option for those who prefer low-risk investments.

In the U.S., cryptocurrency is recognized as a financial asset but not as legal tender. You can still use crypto to buy goods and services wherever it is accepted and you can easily exchange it for U.S. dollars.

Cryptocurrency is mined using computers and advanced software designed specifically for mining new coins. When mining, these computers solve complicated math problems that help validate crypto transactions on the blockchain. This process prevents the possibility of the same crypto being spent twice.

The owners of the mining hardware are then rewarded with new coins for their help keeping everything secure. This process is known as proof of work, and leads to the generation of new coins that will later be in circulation and available for trading.

After selling your crypto, you can pull your money out by transferring the balance from your brokerage account or exchange platform to your bank account.

It’s important to note that different brokers or exchange platforms may have different transfer fees or requirements for withdrawing money. Before you start investing, make sure you understand the withdrawal process and associated fees of your chosen crypto platform.

A security is a tradable financial asset. While it may seem like crypto fits that definition, the U.S. Securities and Exchange Commission (SEC) recognizes cryptocurrencies as commodities rather than securities.

The post What Is Cryptocurrency + How Does Cryptocurrency Work? appeared first on MintLife Blog.